SPACs: A Path to Public Markets That Shouldn’t Be Overlooked

MergersCorp M&A International

JULY 5, 2025

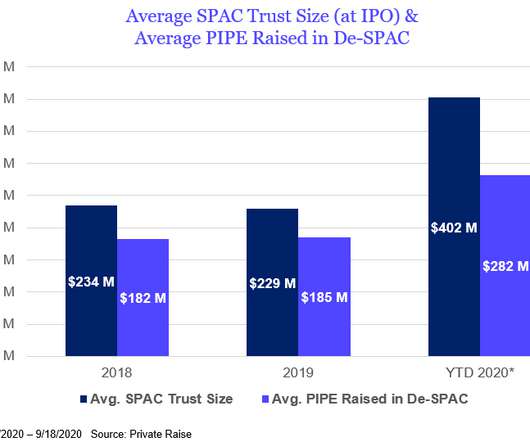

In the frenetic world of finance, few instruments have sparked as much debate, and perhaps as much misunderstanding, as the Special Purpose Acquisition Company, or SPAC. At their core, SPACs are shell corporations formed to raise capital via an initial public offering (IPO) with the sole purpose of acquiring an existing private company.

Let's personalize your content