Reverse Mergers as an IPO Alternative

Deal Lawyers

APRIL 23, 2024

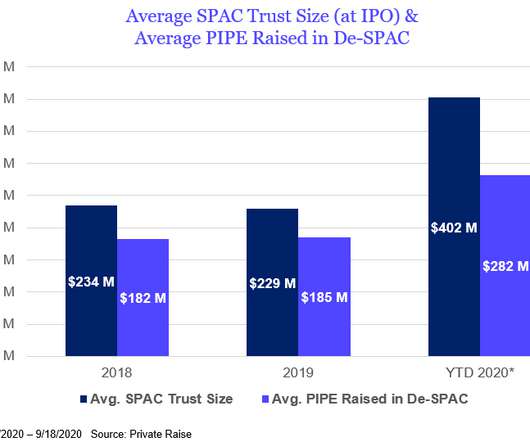

14) says that there’s been an uptick in these deals and that, for some companies, they are an attractive alternative to an IPO: The trend of declining public company valuations (including a […]

Let's personalize your content