How to Sell a Business in Puerto Rico (Without Losing Your Mind or Millions)

How2Exit

JUNE 23, 2025

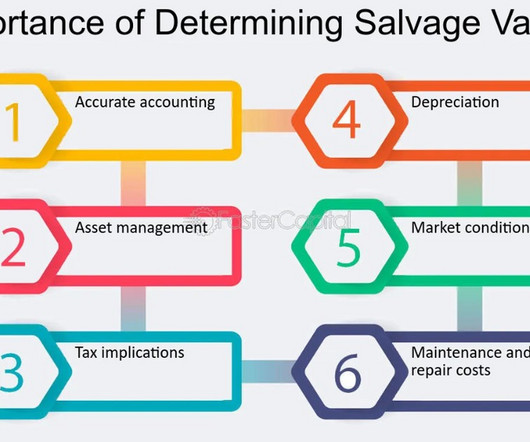

From running a cheese factory to building a supermarket chain, his hands-on entrepreneurial background shaped how he approaches dealmaking in Puerto Rico today. Pre-sale readiness is underrated – Many businesses, especially sub-$3M in revenue, don’t keep formal books. Sloppy books erode it instantly.

Let's personalize your content