Continued Growth in Software and IT Services M&A Expected in 2025

Solganick & Co.

DECEMBER 20, 2024

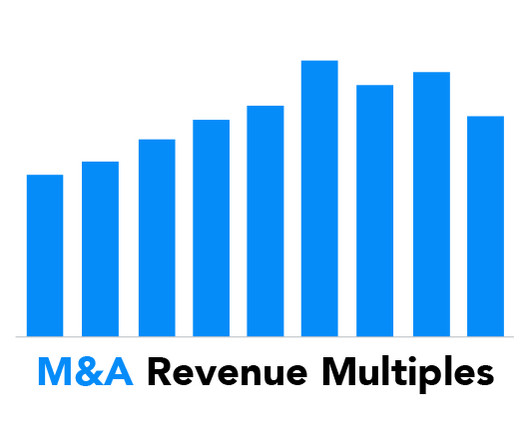

Private Equity Influence: PE-driven deals are expected to reach record highs, driven by the availability of capital and attractive valuations in the software sector. Cybersecurity Concerns: The increasing complexity of cybersecurity threats is leading to consolidation in the cybersecurity sector.

Let's personalize your content