The Art of M&A: How to Identify and Execute Strategic Deals

Sun Acquisitions

JULY 21, 2025

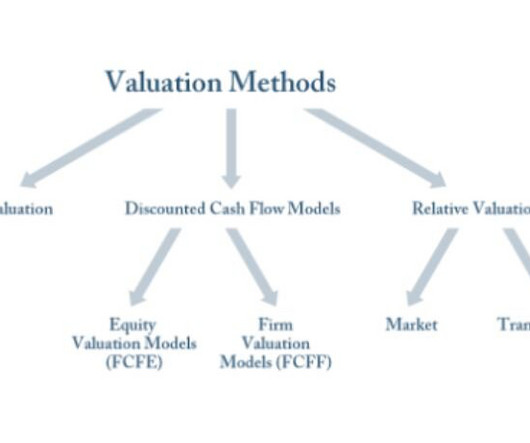

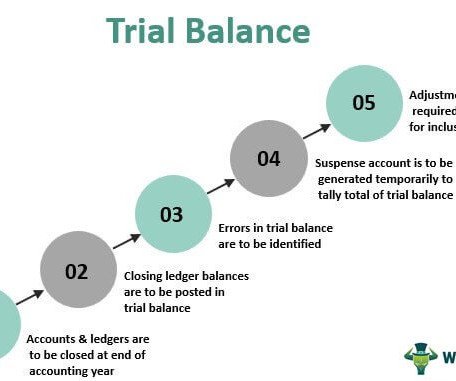

This involves a comprehensive evaluation of the target company, including: Financial Performance: Analyze financial statements, cash flow, and profitability trends. Due Diligence: The Foundation of Success Once potential targets are identified, rigorous due diligence is crucial.

Let's personalize your content