Financial Modeling and Analysis in Mergers and Acquisitions with Paul Barnhurst

How2Exit

DECEMBER 21, 2023

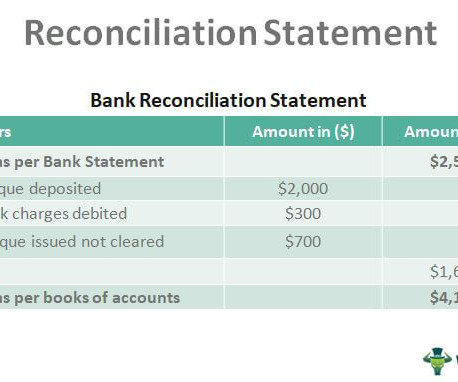

b' E170: Financial Modeling and Analysis in Mergers and Acquisitions with Paul Barnhurst - Watch Here rn rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US. rn "What we measure gets improved. rn "What we measure gets improved.

Let's personalize your content