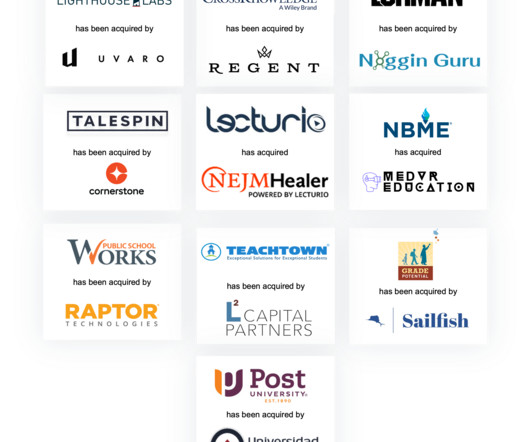

Who Are the Best M&A Advisors for Tech Companies?

iMerge Advisors

APRIL 10, 2025

Whether you're a SaaS founder contemplating a strategic sale, a private equity firm seeking a bolt-on acquisition, or a CEO navigating unsolicited interest, choosing the right M&A advisor is a critical decision one that should be informed by more than just brand recognition. Are they aligned with your goals?

Let's personalize your content