Eyes on the exit: Selling PE portfolio companies in complex markets

JD Supra: Mergers

MARCH 19, 2025

By: White & Case LLP

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MARCH 19, 2025

By: White & Case LLP

How2Exit

JULY 15, 2025

Post-retirement, he advises CEOs, writes, and shares his “strategy-first” philosophy—soon to be published in book form. Small deals can be harder than big ones – Smaller firms often have more emotional barriers to M&A, requiring deeper relationship-building upfront. How you build systems.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mergers and Inquisitions

JANUARY 22, 2025

At the junior levels , entry-level professionals in both fields spend a lot of time in Excel working on models, valuations, and documents such as equity research reports and investment banking pitch books. If you do IB, you can get into deal-based roles ( private equity , corporate development , venture capital , etc.),

CNBC: Investing

AUGUST 2, 2025

The firm's team includes analysts from leading tech private equity firms, engineers and operating partners – former technology CEOs and COOs. The high costs associated with building and maintaining in-house data centers combined with fluctuating data needs allows colocation companies like Equinix to thrive.

Sun Acquisitions

JANUARY 8, 2025

This is music to the ears of strategic acquirers and private equity firms. Private equity buyers who are after targets with stable cash flows and growth potential. The right advisor knows how to position your company optimally, how to build a market of buyers and when to push during negotiations.

Mergers and Inquisitions

MAY 14, 2025

Its effects are less direct in verticals such as data centers and renewables, but if theres a disruption to trade, such as a tariff apocalypse , these sectors will be hurt because it will become more expensive to build and maintain assets. that is sort of infrastructure in the Private Equity Modeling course.

Focus Investment Banking

JULY 25, 2025

So I continued to build my craft and then graduated, couldn’t get a job, went to apply for a, a job at a dealership Body Shop. And then if you want to pick up and do your own daily books, great, go do that. So in, in looking at the pros, if you look at private equity, though, I mean, those are so smart folks over there.

Focus Investment Banking

JUNE 13, 2025

And so it’s just it’s like building a house. Through a level of efficiencies in relationship building and building culture, we were able to continue to grow the business. Josh, you mentioned something that I noted down along the lines of building the foundation before you build the skyscraper on up.

How2Exit

NOVEMBER 12, 2023

b' E159: Building an Empire - Businesses, Private Equity, And M&A - With Adam Coffey - Watch Here rn rn _ rn Sponsor: rn rn Reconciled provides industry-leading virtual bookkeeping and accounting services for busy business owners and entrepreneurs across the US.

OfficeHours

FEBRUARY 9, 2024

Having spent time in technology growth equity and VC in college, I realized quickly that my passions and career goals didn’t align with RX or the exit opps from MM banking to MM private equity. Focus on building your network and asking for help where needed, while trying to add value in return.

Beyond M&A

SEPTEMBER 15, 2023

A Distinctive Voice in the Startup Literature Having had the privilege of delving into countless books on technology, startups, and the philosophy of problem-solving, it’s rare that one resonates deeply and prompts changes to the way you think about product development.

How2Exit

JUNE 20, 2023

Mentor Nick Bradley Nick Doesn't Tweet Nick Bradley @TheNickBradley Nick Bradley is a world-renowned author, speaker, and business growth expert, who works with entrepreneurs, business leaders, and investors to build, scale and sell high-value companies. Host of the #1 Business Podcast in the UK "Scale Up With Nick Bradley".

How2Exit

OCTOBER 2, 2023

With a background in finance and private equity, Codie has closed hundreds of deals and built a portfolio of 26 businesses. She highlights the ease of buying profits compared to building them and encourages listeners to work smarter, not harder. rn rn Quotes: rn rn "Easier to buy profits than it is to build them."

How2Exit

JULY 23, 2023

He emphasizes the need to avoid spreading oneself too thin and instead concentrate on building expertise in a specific area. This approach builds trust and fosters a positive relationship between the buyer and seller, increasing the likelihood of a successful transaction.

How2Exit

MAY 20, 2024

Carl has a storied background, including work with giants like GE and Hewlett Packard, and an impressive stint in private equity. He actively invests in and funds student deals through his private equity fund. He has bought and currently owns roughly 30 companies and has coached nearly 30,000 students worldwide.

Francine Way

JULY 17, 2017

This current post about Leveraged Buy Out (LBO) is about a valuation method used by a very specific type of financial acquirer: private equity (PE) firms. The major steps of LBO are: Building the Sources and Uses tables. Building a proforma balance sheet. Building the go-forward 3-statement model.

How2Exit

APRIL 2, 2024

He is an alumnus of UC Berkeley and previously worked at Industry Ventures, a venture capital and private equity firm. He also authored a book, "Grit It Done," and is committed to helping others achieve their American dream of business ownership. rn rn rn "What gets focused gets done."

The Deal

SEPTEMBER 7, 2023

In his time at Bain, a Boston-based private equity sponsor, he had seen the evolution of multistrategy credit businesses at sponsors, and he believed there was an opportunity to provide outside counsel on credit deals, which often evolve quickly. I live my life as an open book,” he said. “If

Mergers and Inquisitions

MAY 10, 2023

If you have a bad day (client emergency, deal blow-up, last-minute pitch book, etc.), Investment Banking in Singapore: Exit Opportunities The standard exit opportunities – private equity , hedge funds , and corporate development – are all available in Singapore, but everything is smaller. you might be at the office until 5 AM.

How2Exit

MAY 2, 2023

This will help to build trust between the buyer and the employees, and to ensure that the transition is successful. Additionally, the buyer should discuss any retention plans they may have, such as giving employees equity in the company, or offering stock options. This will help to build trust between the employees and the new owner.

Peak Frameworks

MAY 17, 2023

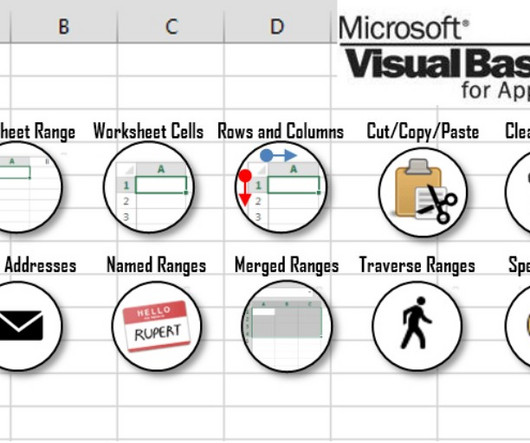

Additionally, if you’re interested in refining your Excel skills and recruiting for private equity, you should check out our , Private Equity Course. For example, in 2013, JPMorgan used VBA to build a custom model to forecast loan losses, which helped them save time and improve accuracy.

Focus Investment Banking

MAY 22, 2025

Insurance brokerages stand out for their reoccurring revenue models, strong cash flows, and low capital intensity all factors that make them highly sought after by both strategic buyers and private equity platforms. Why It Matters As private equity acquisitions continue to drive roll-up strategies across the U.S.,

Mergers and Inquisitions

SEPTEMBER 25, 2024

OK Reasons” to Do It 1) You Get Forced Out of Your Company But Want to Remain in the Industry 2) You Need to Gain Credibility or Build a Wider Network 3) You May Not “Need” an MBA to Change Careers, But It Could Improve Your Odds Is an MBA Worth It? no pre-MBA finance experience to private equity ).

How2Exit

FEBRUARY 23, 2023

You must be willing to explore different sources for deals, build relationships within your industry or niche, and reach out directly to business owners. Empathy involves understanding the other party’s perspective, building rapport, and using effective communication. Using effective communication is also important.

How2Exit

OCTOBER 3, 2022

They join cloud services, mobile, SaaS, and data as the most sought among private equity and strategic buyers. For all buyers, they have three choices relating to IP: Buy, build, or partner. While it takes years to build a strong brand, any damage to your MSP’s brand lives ad infinitum on the internet. (PS:

Growth Business

FEBRUARY 28, 2024

In May 2023, engineering firm Dyson also announced plans to build a £100 million R&D hub in the city to be home to hundreds of software and AI engineers. Clients initially book a call with Deazy to discuss development requirements. The startup, which was founded in 2018, was granted £2.5 million to date. #7

The Deal

JULY 18, 2023

Anderson expects to continue to keep the train rolling at a healthy pace over the next several years as he pursues the goal of building his company into a $150 million to $200 million-in-Ebitda business in the next five years. The firm has more than doubled its head count since 2020. “They know what’s in my head,” he said.

Mergers and Inquisitions

APRIL 24, 2024

For example, if you have no finance experience , it is highly unlikely that you will get an offer at a multi-manager hedge fund or private equity mega-fund after the degree. If you’re targeting an informal venture capital internship , private equity internship , or search fund internship , focus on smaller, local firms.

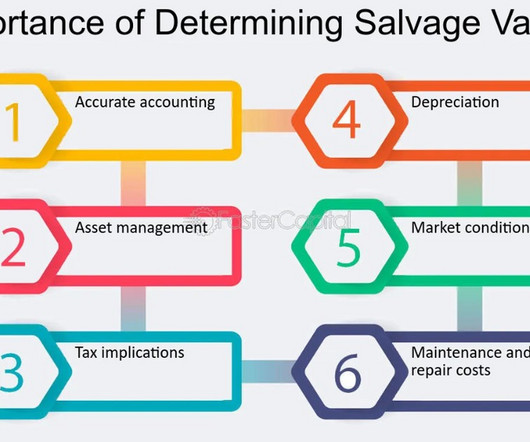

Peak Frameworks

MAY 8, 2024

If you're interested in breaking into finance, check out our Private Equity Course and Investment Banking Course , which help thousands of candidates land top jobs every year. Salvage Value Role: Acts as a threshold that depreciation cannot reduce the book value of the asset below. What is Salvage Value?

iMerge Advisors

APRIL 14, 2025

Buyers whether strategic acquirers or private equity firms will typically expect at least GAAP-compliant financials. While not every company needs an audit, here are scenarios where theyre strongly recommended or expected: Enterprise value exceeds $10M$15M Private equity buyers are involved Complex revenue models (e.g.,

Tyton Partners

MARCH 28, 2024

Only McGraw-Hill retained its name, but it too had found itself subject to a split back in 2013, when it was sold out of publicly traded McGraw-Hill Companies to a private equity firm. Pearson then became Savvas Learning. The smart “runners” have already shifted their training regiments.

Mergers and Inquisitions

JANUARY 10, 2024

For example, they might ask you how to use a DCF, what bond yields are, or the trade-offs of debt vs. equity – but but they won’t ask you to build a DCF model or calculate Unlevered Free Cash Flow. As with the job itself, the theme is breadth over depth.

Focus Investment Banking

OCTOBER 30, 2023

Lower margins, in many cases, make these businesses unattractive to all but a small handful of financial investors like private equity groups, who look to invest, build a company up and then often sell to a larger private equity group. What are the top benefits of an ESOP for a tire dealer?

IBG

SEPTEMBER 11, 2024

That is especially true when the buyer is a private equity group or other type of “financial” buyer, which is the case in seven out of 10 deals that we have closed over the last several years. It should come as no surprise, then, that a major focus of most buyers is on the company’s income statement and related financial information.

How2Exit

JUNE 26, 2023

Communication is also key when it comes to building excitement and removing fear, uncertainty, and doubt. Additionally, companies should spend two to three years prepping their books and revenue to maximize value. This means that different buyers may value a business differently based on their own unique criteria.

How2Exit

AUGUST 28, 2023

rn Ronald shares what he's seeing as the behavior of private equity firms in the current market. The podcast mentions that clients can come to the service provider before even signing a Letter of Intent (LOI) and ask for guidance on building their deal team and budgeting for due diligence.

Mergers and Inquisitions

APRIL 19, 2023

On the producer side, you can see how much they spend to build new plants, factories, and processing centers. Key Uses: Since copper is the best conductor of electricity among non-precious metals, it’s widely used in machinery, appliances, batteries, and even electrical wiring for entire buildings.

Mergers and Inquisitions

JULY 17, 2024

They’re mostly supporting pitch books and deal execution in other regions, not working on domestic deals from start to finish. Case studies are also more likely to come up, but you probably won’t have to build a detailed model unless you have previous experience. or Europe and recruiting there.

Mergers and Inquisitions

SEPTEMBER 11, 2024

For example, if a renewable developer wanted to raise debt to build a new offshore wind farm as a separate entity, it would fall under Project Finance. 132) ConEdison / Sempra Solar – Acquisition (CCA, Citi, Lazard, CS, and JPM) Investor Presentation Shanghai Xingsheng Equity Investment & Management Co.

GillAgency

FEBRUARY 10, 2022

Build a winning team It is a common practice for business owners to keep the sale process hushed and try to do it alone. So, you need to start by building an exit team. Financial Role You will need to have very clean books, records and financials as well as a bullet-proof valuation of your business – the purchase price.

Beyond M&A

SEPTEMBER 5, 2023

As Managing Partner of a UK-based Technology Due Diligence firm, I’ve gained valuable insights that I believe could benefit my team and our broader audience, comprising venture capitalists, private equity players, corporate investors, and tech founders or CTOs. My focus was on building a trustworthy team and a positive work culture.

Sun Acquisitions

OCTOBER 5, 2022

If the business is indeed in trouble, it’s key that you first attempt to raise its profile by boosting sales, building a stronger client base, and accruing regular revenue. Saying that you’re selling the business because it is in distress and struggling is a turn-off for any investor. Step 2: Determine when you plan to sell.

How2Exit

NOVEMBER 11, 2024

E256: Why Private Equity is Hungry for Small Businesses – Here's How You Can Cash In - Watch Here About the Guest(s): Adam Coffey is a renowned CEO specializing in running private equity companies, a best-selling author, and a veteran in the business industry. billion in exits. billion in exits.

How2Exit

MARCH 17, 2025

His latest project is his book Paycheck to Freedom , co-authored with Tom Wheelwright, aimed at guiding people from employment to business ownership. SBA Lending as a Wealth-Building Tool – SBA loans, especially the 7(a) and 504 programs, provide pathways for entrepreneurs to finance businesses with as little as 10% down.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content