Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

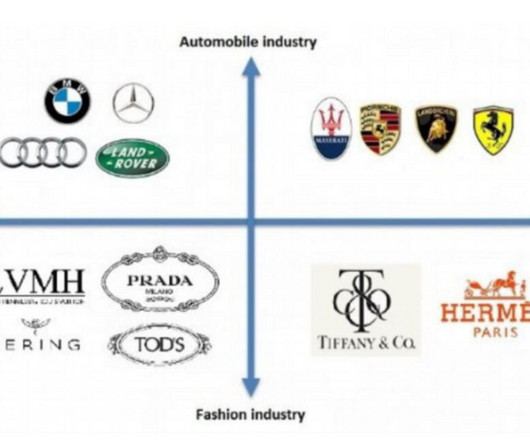

Common Valuation Methods: Comparable Company Analysis: Compare the target company to similar publicly traded companies. Valuation: Determining the Fair Valu e Valuation is the process of determining a company’s fair market value. Accurate valuation is essential for successful M&A deals.

Let's personalize your content