Best Practices for Due Diligence in Government Contractor M&A Transactions

JD Supra: Mergers

JUNE 10, 2025

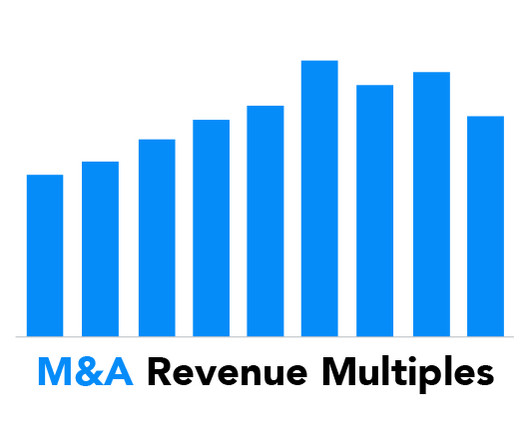

Mergers and acquisitions (M&A) involving government contractors present unique challenges and considerations that require meticulous due diligence. government. government. This blog post outlines some of the basic best practices for due diligence when acquiring or selling a business that performs U.S.

Let's personalize your content