Striking the Balance: Key Negotiation Points in Today’s Agreements

Focus Investment Banking

JUNE 17, 2025

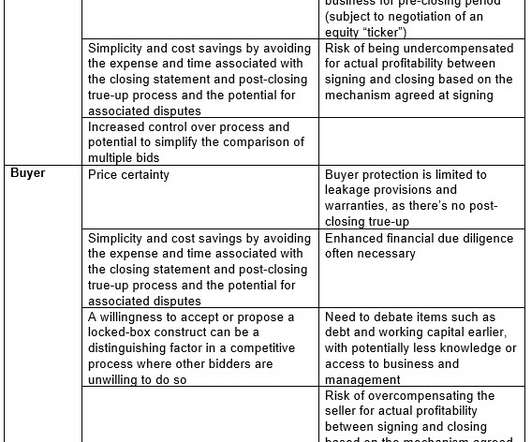

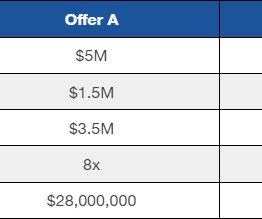

Striking the Balance: Key Negotiation Points in Today’s Agreements The M&A landscape is always transforming. Letters of Intent (LOIs) have evolved from brief outlines of deal terms to detailed blueprints, setting the stage for negotiations long before the purchase agreement is drafted.

Let's personalize your content