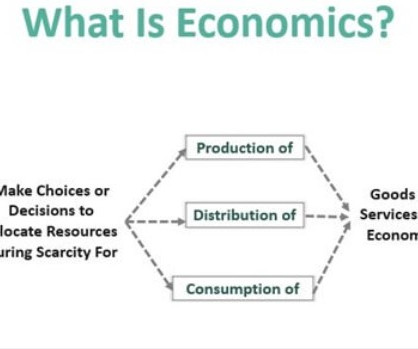

Negotiating Economics: What are the Different Advantages of Co-Investment for GPs and LPs?

JD Supra: Mergers

JULY 16, 2025

billion in 2024, despite a muted dealmaking environment and investor liquidity constraints (Trends Shaping the Private Equity Co-Investment Landscape - Chronograph). Co-investment activity has increased fivefold over the past two decades, hitting a record $33.2 The advantages for both GPs and LPs are clear.

Let's personalize your content