SaaS M&A Due Diligence Checklist: Prepare 6 Areas of Your Business for a Successful Exit

Software Equity Group

JUNE 25, 2025

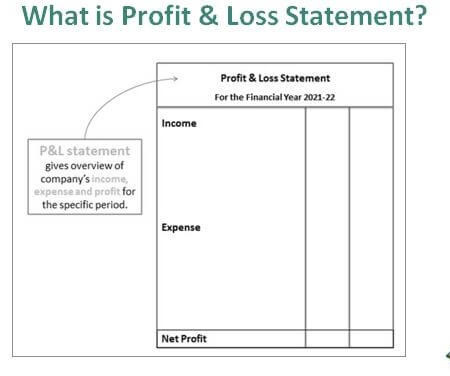

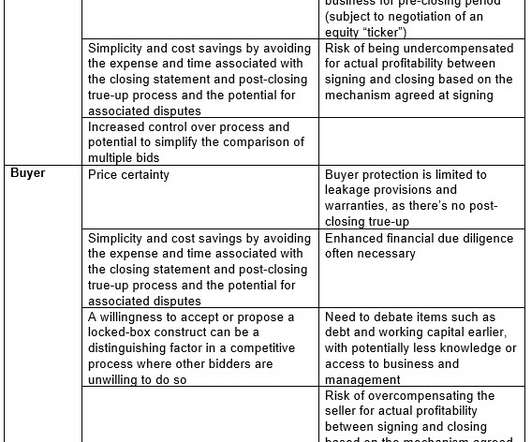

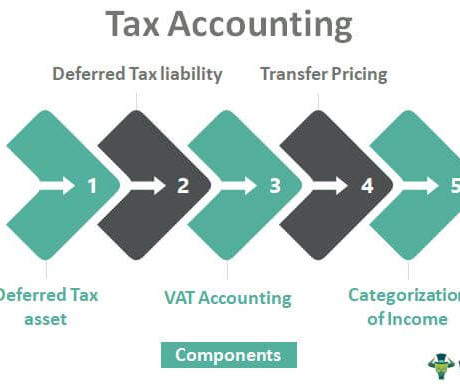

This means providing annual financial statements, detailed financial statements, access to historical audit work papers, a description of any significant or unusual accounting controls, and copies of the top five customer and vendor contracts. Consider these 11 areas of accounting due diligence.

Let's personalize your content