Lessons Learned from Successful M&A Deals

Sun Acquisitions

JUNE 23, 2025

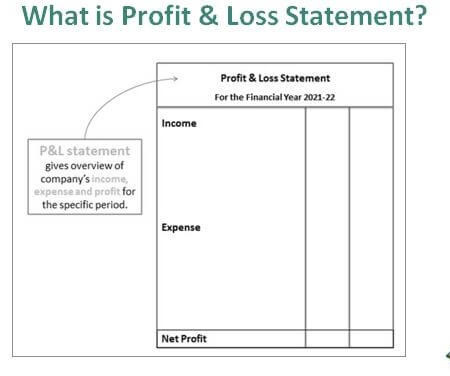

Thorough Due Diligence: Financial Due Diligence: Conduct a comprehensive financial analysis to assess the target company’s financial health, including its revenue, profitability, and debt levels.

Let's personalize your content