PCE Welcomes Bradley Scharfenberg as Vice President, M&A

PCE

JUNE 9, 2025

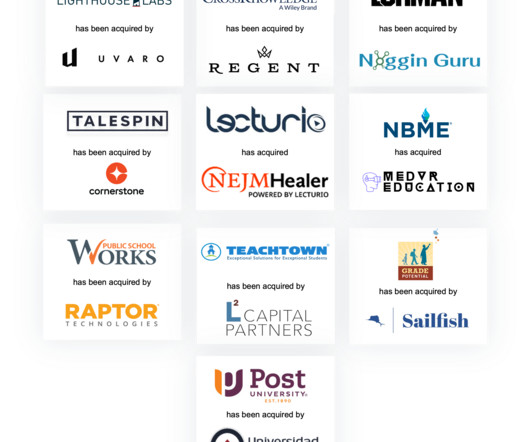

At PCE, he’ll lead execution for sell-side and buy-side engagements, recapitalizations, and capital raises, with a strong focus on expanding our healthcare investment banking practice. Joining PCE is an exciting opportunity to bring my healthcare experience to a team that truly values long-term client relationships,” said Brad.

Let's personalize your content