Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

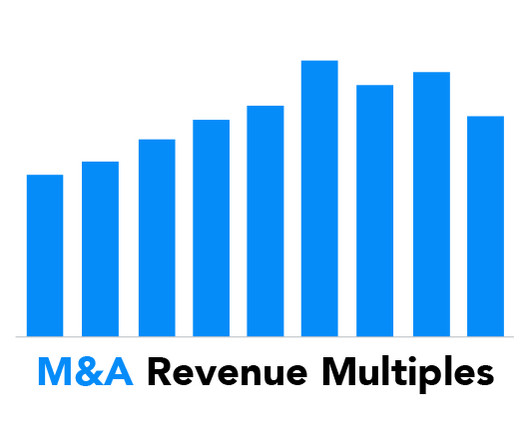

Due diligence and valuation are critical to any successful merger and acquisition (M&A) deal. Assess the company’s management team and employee base. Valuation: Determining the Fair Valu e Valuation is the process of determining a company’s fair market value.

Let's personalize your content