Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

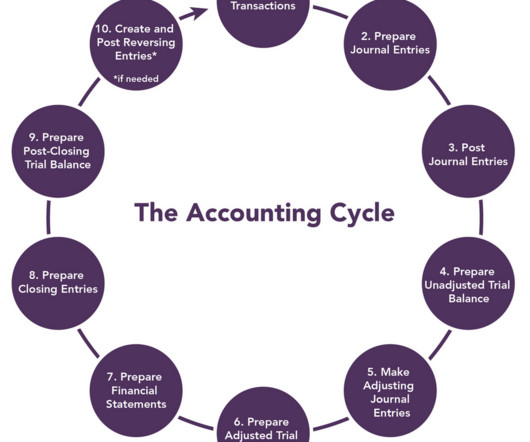

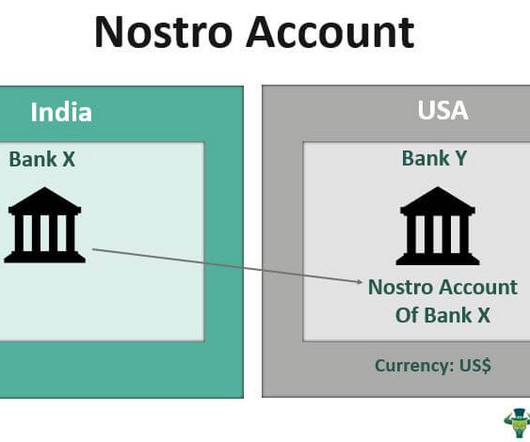

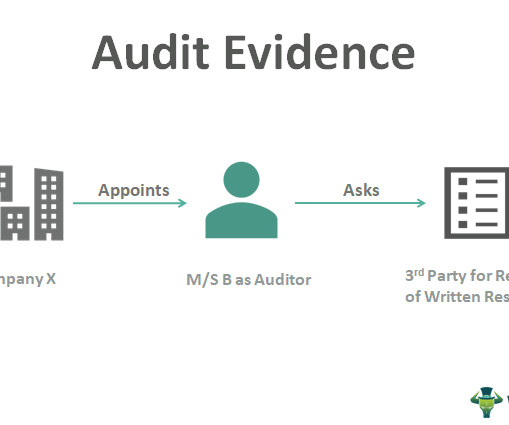

Due Diligence: A Deep Dive Due diligence is a comprehensive investigation of a target company’s financial, operational, and legal aspects. Key areas to focus on during due diligence: Financial Due Diligence: Review financial statements, tax returns, and other financial records.

Let's personalize your content