Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

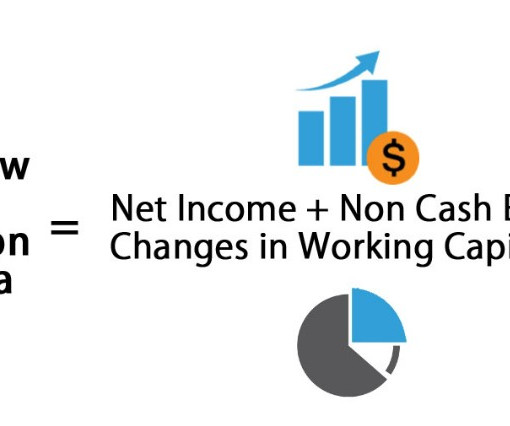

Discounted Cash Flow (DCF) Analysis: Projects future cash flows and discounts them to their present value. Best Practices for Successful Due Diligence and Valuation Engage Experienced Professionals: Hire experienced M&A advisors, lawyers, and accountants to assist with the due diligence and valuation process.

Let's personalize your content