Equiteq New York Summer Internship Program 2022

Equiteq

AUGUST 24, 2022

The Equiteq team also put on training sessions on key skills required in a career in investment banking such as financial modeling and presentation skills.

Equiteq

AUGUST 24, 2022

The Equiteq team also put on training sessions on key skills required in a career in investment banking such as financial modeling and presentation skills.

OfficeHours

AUGUST 20, 2023

If you enjoy financial modeling and due diligence (essential skills for most finance roles) but want to dig deeper into how businesses function operationally, then the buyside could be right for you. Many first-year (and some second-year) analysts are unsure if private equity should be their next step. Join OfficeHours Today!

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Mergers and Inquisitions

MARCH 13, 2023

Look at any financial model for a bank, and you’ll see that loans – not deposits – are the key top-line driver. Insufficient/No Hedges – Rather than hedging their entire MBS portfolio with interest-rate swaps, the bank had… no swaps at all as of the end of 2022 ( oh, and no Chief Risk Officer, either ).

M&A Leadership Council

FEBRUARY 15, 2023

The 2023 M&A Integration Mandate That advice resonated viscerally with me in 2022 as my client’s CEO demanded their highly experienced M&A team embrace an existential challenge to its survival. Either find a way to do integration 50% better, faster and leaner than we’ve ever done it before, or we’ll find a team that can!”

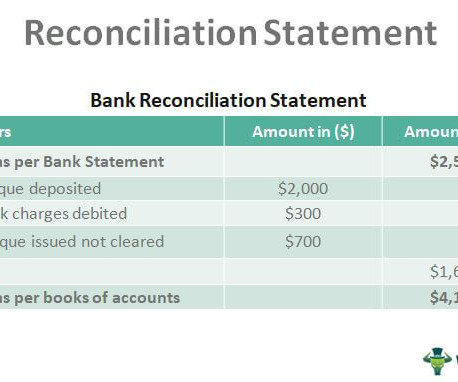

Wall Street Mojo

JANUARY 18, 2024

The bonds mature on 31st Dec 2022. Unlock the art of financial modeling and valuation with a comprehensive course covering McDonald’s forecast methodologies, advanced valuation techniques, and financial statements. payable semi-annually maturing after 5 years with a principal face value of $1000 on 1st January 2018.

Mergers and Inquisitions

DECEMBER 6, 2023

You might think that as a Hedge Fund Analyst , you’ll do deep market research, speak with counterparties, suppliers, and customers, and build detailed financial models to support your views… …and you would do those things if you were at a single-manager hedge fund. What Do You Do as a Multi-Manager Hedge Fund Analyst?

Wall Street Mojo

JANUARY 16, 2024

Financial Modeling & Valuation Courses Bundle (25+ Hours Video Series) –>> If you want to learn Financial Modeling & Valuation professionally , then do check this Financial Modeling & Valuation Course Bundle ( 25+ hours of video tutorials with step by step McDonald’s Financial Model ).

Let's personalize your content