Goodwin REIT Alert: Trends in REIT M&A (2022-2023)

JD Supra: Mergers

OCTOBER 13, 2023

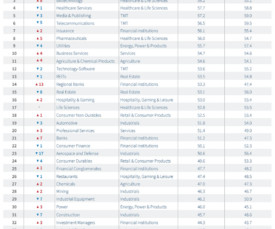

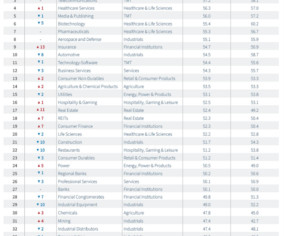

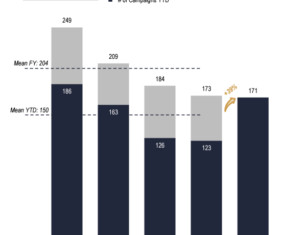

In our 2022 alert “REIT M&A Trends Through the Pandemic,” we cataloged a total of 42 new REIT transactions announced between August 2020 and May 2022, a pace that rivaled or exceeded pre-pandemic levels.

Let's personalize your content