Global software M&A volume rebounds

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

This site uses cookies to improve your experience. By viewing our content, you are accepting the use of cookies. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country we will assume you are from the United States. View our privacy policy and terms of use.

JD Supra: Mergers

MAY 18, 2023

Tech valuations fell through the second half 2022 and M&A in the sector shifted gears producing a rise in lower-value deals, particularly among private equity (PE) firms.

Sica Fletcher

MARCH 12, 2024

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

Software Equity Group

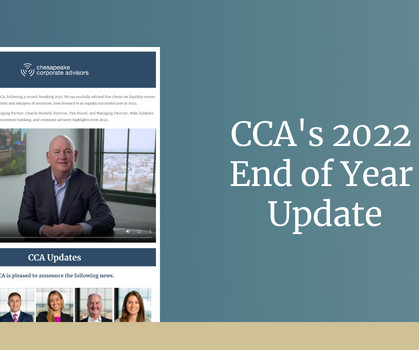

MAY 8, 2024

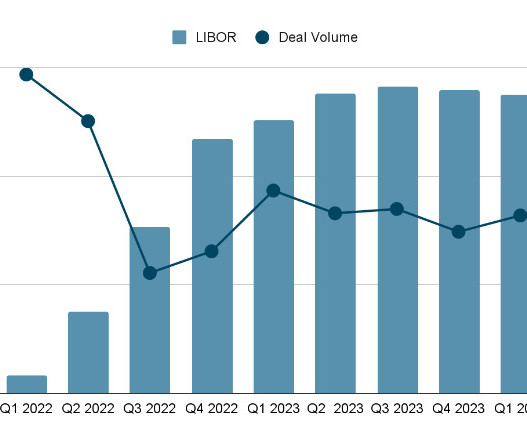

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. In 2022 and 2023, the Fed raised interest rates repeatedly to counteract high inflation.

Software Equity Group

MAY 7, 2024

But what are the key influences shaping valuation multiples in today’s M&A deals? As you contemplate your exit strategy, it becomes increasingly crucial to understand the external factors driving the valuation of your SaaS company. In 2022 and 2023, the Fed raised interest rates repeatedly to counteract high inflation.

Software Equity Group

FEBRUARY 28, 2023

Our report provides context for private companies to better understand factors influencing their valuations and evaluate how they can position themselves within a changing marketplace. It is no secret that 2022 was a rough year for the stock market. At the end of 2022, EV/Revenue multiples were still 15% higher than in 2018.

Software Equity Group

DECEMBER 18, 2023

Given geopolitical instability, high interest rates, and the perception that B2B SaaS valuation multiples are declining, it is no great surprise that many founders interested in pursuing a transaction are considering delaying a liquidity event. Continue reading to learn more about what is driving today’s B2B SaaS valuation multiples.

JD Supra: Mergers

SEPTEMBER 20, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Consumer Finance - Europe's consumer finance decacorns stumble as their valuations crumble. By: White & Case LLP

JD Supra: Mergers

JUNE 28, 2023

In this blog, we posit that “before” refers to the “bull market” that ended in January 2022, and “after” refers to everything that – happened, is happening, and will happen – next. History is often written by reference to “before” and “after.” By: Foley & Lardner LLP

JD Supra: Mergers

SEPTEMBER 25, 2023

UK & European Financial Services M&A: Sector trends H2 2022 | H1 2023 — Fintech - Whilst many European start-ups have struggled to successfully execute funding rounds at valuation levels of yesteryear, more mature fintechs have pivoted to acquisitions and partnerships to fuel growth.

Solganick & Co.

OCTOBER 7, 2022

October 7, 2022 – Manhattan Beach, CA – Solganick & Co. has published its latest Healthcare IT M&A Update for Q3 2022. The report covers the latest mergers and acquisitions trends and valuations for the industry sector. ’s Healthcare IT M&A Group Solganick & Co.

Chesapeake Corporate Advisors

JANUARY 13, 2023

2022 was a strong year for CCA, following a record-breaking 2021. In the video below, CCA Managing Partner, Charlie Maskell, Director, Tim Brasel, and Managing Director, Mike Zuidema break down the CCA team, investment banking, and corporate advisory highlights from 2022.

Software Equity Group

DECEMBER 21, 2023

Here’s a closer look at what the future looks like for the SaaS M&A market and its valuation multiples. Forty-one percent said they’ve seen either no change or an increase in valuations since 2022 for the high-quality assets they are targeting, and nearly 50% said they expected to see valuations increase in 2024.

Solganick & Co.

SEPTEMBER 30, 2022

September 30, 2022 – Manhattan Beach, CA and Dallas, TX – Solganick & Co. has published its latest Healthcare IT M&A Update for Q2 2022. You can download the full report here: Solganick HCIT Q2 2022 M&A transactions have remained active in the healthcare IT sector in Q2 2022. Consumer Health 3.7x

Cooley M&A

JANUARY 25, 2023

Tech M&A in 2022 was a tale of two halves. billion [1] during the first half of 2022 to $189.17 billion in the second half, resulting in total 2022 volume of $720.3 billion [1] during the first half of 2022 to $189.17 billion in the second half, resulting in total 2022 volume of $720.3 trillion. [2] trillion.

TechCrunch: M&A

JUNE 22, 2023

The company announced its most recent raise of $15 million in December, when it also touted a 50% boost in its valuation. On the one hand, while X1’s valuation is not known, it looks like Robinhood is getting a good deal with $95 million. For example, Petal raised $140 million in 2022 at an $800 million valuation.

FineMark

JANUARY 20, 2023

These periods are now known as “Minsky Moments.” 2022: One for the Record Books These days, words such as “unprecedented” or “extraordinary” seem overused in our daily vernacular, however, they do feel appropriate when describing 2022. Seventy years of peace in Europe were shattered as Russia invaded Ukraine in February 2022.

Cooley M&A

JANUARY 9, 2023

On November 8 and 9, Cooley and the Berkeley Center for Law and Business presented the 2022 Berkeley Fall Forum on Corporate Governance. Discussions covered trends and lessons from financial transactions and corporate strategy in the volatile 2022 environment and insights into the year ahead.

M&A Leadership Council

DECEMBER 24, 2021

Event Dates: 2022-06-28T09:00:00-05:00 to 2022-06-28T12:30:00-05:00 2022-06-29T09:00:00-05:00 to 2022-06-29T12:30:00-05:00 2022-06-30T09:00:00-05:00 to 2022-06-30T12:30:00-05:00 Location: Online. Register Now. Course Description.

M&A Leadership Council

DECEMBER 24, 2021

Event Dates: 2022-05-24T09:00:00-05:00 to 2022-05-24T12:30:00-05:00 2022-05-25T09:00:00-05:00 to 2022-05-25T12:30:00-05:00 2022-05-26T09:00:00-05:00 to 2022-05-26T12:30:00-05:00 Location: Online. Register Now. Course Description.

JD Supra: Mergers

JULY 12, 2023

Overview - The year 2022 started strong but proved to be a mixed year for M&A in what could be described as a return to earth after the record-setting year that was 2021. M&A market alone exceeded $2 trillion in 2021 – a staggering figure that crushed (by nearly 30%) the then-existing record established in 2015. By: Troutman Pepper

Cooley M&A

JANUARY 25, 2023

Although 2022 saw a general decline in M&A activity in the life sciences industry compared to 2021’s frenetic pace (when deal volume was up 52% from 2020 ), life sciences deal flow in 2022 on balance remained strong despite the headwinds. Let’s dig in. Let’s dig in.

Lake Country Advisors

JULY 5, 2022

Various sectors from different industries have experienced consistent growth in 2022, thanks to the professional services of reliable M&A business advisors in Wisconsin. Why is it a Seller’s Market for a Merger or Acquisition in 2022? How to Sell a Profitable Wisconsin Business in 2022?

TKO Miller

APRIL 20, 2023

We have all seen the data about M&A valuations decreasing and deal volume falling in the second half of 2022. Unfortunately, data as of April, 2023 shows a continued decline in both volume and valuations across the board for almost all sectors and sizes of transactions.

Global Newswire by Notified: M&A

DECEMBER 11, 2023

Consumer Battery Market to Develop Progressively; Growing Demand for Household Electrical Appliances to Propel Market Growth: Fortune Business Insights™ Consumer Battery Market to Develop Progressively; Growing Demand for Household Electrical Appliances to Propel Market Growth: Fortune Business Insights™

Global Newswire by Notified: M&A

NOVEMBER 28, 2023

billion in 2021 and is expected to reach a valuation of USD 13.82 billion in 2022. billion in 2021 and is expected to reach a valuation of USD 13.82 billion in 2022. billion in 2021 and is expected to reach a valuation of USD 13.82 billion in 2022. The market is expected to reach USD 164.10

Global Newswire by Notified: M&A

NOVEMBER 29, 2023

Gear Motor Market is Anticipated to Reach Valuation of USD 8.91 During the Forecast Period 2022-2029: Fortune Business Insights™ Gear Motor Market is Anticipated to Reach Valuation of USD 8.91 During the Forecast Period 2022-2029: Fortune Business Insights™ Billion by 2029 with a CAGR of 3.4%

How2Exit

MAY 27, 2024

rn rn rn Article: rn Thriving in the E-Commerce M&A Space: Strategies for Buyers and Sellers rn Navigating the intricate world of buying and selling businesses requires a nuanced understanding of market trends, valuation practices, and strategic negotiation. Great investment." No one wants to buy that."

TKO Miller

AUGUST 30, 2023

middle market valuation multiples and deal volume are down slightly through Q2 of 2023. this year through June 2023, but middle market valuations are down approximately 8% based on the TKO Miller analysis. Paperboard prices have also come down significantly from their peak in late 2022. Packaging Trends Q2 M&A Update U.S.

Growth Business

SEPTEMBER 25, 2023

By Dom Walbanke on Growth Business - Your gateway to entrepreneurial success The British Business Bank has recorded a £135m loss in the year ending March after a drop in portfolio valuations. After the pandemic, we have re-focused on the UK’s future economic growth as we deliver against our new strategic objectives from 2023/24.

Global Newswire by Notified: M&A

AUGUST 1, 2023

million in 2022 and is projected to reach a valuation of USD 41.8 million in 2022 and is projected to reach a valuation of USD 41.8 As per the report by Fortune Business Insights, The subdural electrodes market size was valued at USD 32.4 million in 2023. The market is expected to reach USD 73.9 million in 2023.

Global Newswire by Notified: M&A

JULY 27, 2023

billion in 2022 and is projected to reach a valuation of USD 9.32 billion in 2022 and is projected to reach a valuation of USD 9.32 As per the report by Fortune Business Insights, The ultrasound equipment market size was valued at USD 8.70 billion in 2023. The market is expected to reach USD 15.21 billion in 2023.

PCE

JANUARY 16, 2024

2024 is poised to be another strong year for employee stock ownership plan (ESOP) transactions, with deal volume expected to eclipse 2023’s (reaching toward the highly favorable dynamics of 2021 and 2022), thanks to four key underlying drivers that should push through any economic or political uncertainty: Succession plans for countless businesses (..)

TechCrunch: M&A

MAY 31, 2023

Financial terms of the deal, which marks Stripe’s first acquisition since it bought card reader provider BBPOS in January of 2022, were not disclosed. It was while pitching Stripe in 2022 that the small startup “really hit it off with the engineering leaders, and “from there, it evolved into more of an acquisition discussion,” said Boulander.

Sica Fletcher

APRIL 2, 2024

Insurance M&A Deal Valuation, 2024 Starting out in 2024, EBITDA and revenue multiples are in a good place, experiencing modest YoY growth despite the economic downturn of the last 18 months. We have also linked sources from our third-party research in the section at the bottom of this page.

Focus Investment Banking

JUNE 12, 2023

Thriving US Middle Market Fundraising and Resilient Private Equity Regarding Global M&A Private Equity Trends, looking at the positive news, the US middle-market fundraising landscape remained stable throughout 2022, with 156 funds closing at an aggregate value of $133.5 trillion as of June 30, 2022.

Global Newswire by Notified: M&A

JULY 11, 2023

billion in 2022 and is projected to reach a valuation of USD 14.40 Pune, India, July 11, 2023 (GLOBE NEWSWIRE) -- The global sun care products market size was valued at USD 13.97 billion in 2023. The market is expected to reach USD 19.65 billion by 2030 with a CAGR of 4.5% during the forecast period.

Global Newswire by Notified: M&A

JULY 11, 2023

billion in 2022 and is projected to reach a valuation of USD 27.63 Pune, India, July 11, 2023 (GLOBE NEWSWIRE) -- The global yoga clothing market size was valued at USD 25.74 billion in 2023. The market is expected to reach USD 46.67 billion by 2030 with a CAGR of 7.78% during the forecast period.

Global Newswire by Notified: M&A

SEPTEMBER 14, 2023

billion in 2022 and is projected to reach a valuation of USD 3.89 Pune, India, Sept. 14, 2023 (GLOBE NEWSWIRE) -- The global hand wash market size was valued at USD 3.67 billion in 2023. The market is expected to reach USD 6.25 billion by 2030 with a CAGR of 6.99% during the forecast period.

TechCrunch: M&A

JUNE 27, 2023

billion valuation during the heady fundraising days of late 2021 (and $100 million earlier in 2021), today announced that it has acquired identity verification service Berbix for $70 million in cash and stock transactions. He noted that Socure’s revenue grew over 50% in 2022, all while other companies in the space were flat to down.

Trout CPA: M&A

NOVEMBER 23, 2022

According to BDO’s Life Sciences CFO Survey, 33% of CFOs planned to pursue M&A in 2022, up 25% from the 2021 survey. For life sciences companies, M&A and collaborations are a key strategy for growth, building product pipelines, and getting products to market as quickly as possible.

Cooley M&A

FEBRUARY 1, 2024

2023’s much-discussed downturn in mergers & acquisitions – with global M&A volume and value down 6% and 17%, respectively, from 2022 – was largely driven by the slowdown in the tech sector, with global tech M&A volumes down 51% year over year, while other sectors saw marked increases. [1]

Global Newswire by Notified: M&A

AUGUST 9, 2023

billion in 2022 and is projected to reach a valuation of USD 8.11 Pune, India, Aug. 09, 2023 (GLOBE NEWSWIRE) -- The global small caliber ammunition market size was valued at USD 8.00 billion in 2023. The market is expected to reach USD 9.78 billion by 2030 with a CAGR of 2.72% during the forecast period.

Software Equity Group

MARCH 13, 2023

The public markets may have taken a beating, but behind the gloom-and-doom headlines, there was still plenty of good news for private SaaS companies in 2022. Following are some highlights of SaaS M&A deal activity over 2022. Median EV/TTM Revenue Multiple Down from 2021’s high of 7.3x, 2022’s median EV/Revenue multiple of 5.6x

Growth Business

JULY 19, 2023

Some commentators predicted 2022 would be even bigger. There’s a lot of capital available to start-ups today, and seed rounds in 2022 were closer to the Series A rounds of 2012. Alongside raise amount and dilution is the all-important valuation. On valuation, there’s one golden piece of advice: never suggest one to a VC.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content