Danny Moses of ‘The Big Short’ breaks down why he likes the unloved energy sector now

CNBC: Investing

JUNE 9, 2025

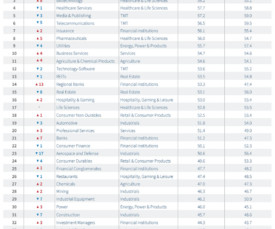

It makes much more economic sense to own these stocks." The Moses Ventures founder pointed out that energy stocks' weighting in the S & P 500 benchmark is only 3% right now, compared to their historical average of 7%. " "These energy stocks, the last four to five years, have gone through transformational M & A.

Let's personalize your content