FOCUS Investment Banking Represents Stillwater Technologies in its Sale to ReNEW Manufacturing Solutions

Focus Investment Banking

JANUARY 17, 2025

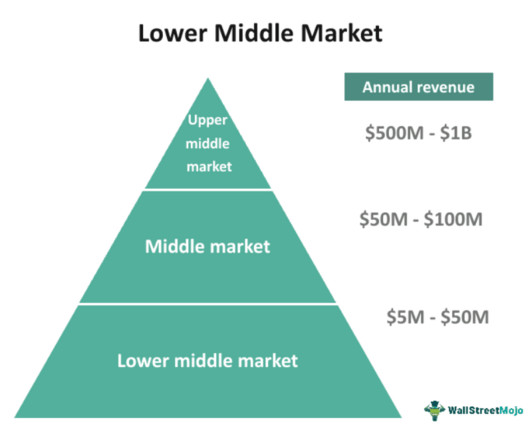

Washington, DC (January 17, 2024) FOCUS Investment Banking (FOCUS), a national middle market investment banking firm providing merger, acquisition, divestiture, and corporate finance services, announced today that Stillwater Technologies LLC (Stillwater) has been acquired by ReNEW Manufacturing Solutions (ReNEW).

Let's personalize your content