Eyes on the exit: Selling PE portfolio companies in complex markets

JD Supra: Mergers

MARCH 19, 2025

By: White & Case LLP

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

MARCH 19, 2025

By: White & Case LLP

CNBC: Investing

JUNE 9, 2025

The stock opened that day at $69.69, or 34% above its IPO, and closed up nearly 29% at $67 per share. The overwhelming positive sentiment from Wall Street has rewarded the company's decision to go public after a lengthy dry spell for IPOs. Here's what analysts at some of the biggest shops on Wall Street had to say on the IPO.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

CNBC: Investing

JUNE 14, 2025

The Wall Street firm says these companies are resilient and that investors should quickly buy them. CNBC Pro combed through Goldman Sachs research to find five buy-rated stocks that it says have more upside. They include: Apple, MasTec, BJ's, Valvoline and Kontoor Brands.

CNBC: Investing

JULY 8, 2025

"We are upgrading PNC shares from Market Perform to Outperform, increasing our EPS estimates following recent commentary at an investor conference, and establishing a $220 price target." " Raymond James upgrades PNC to outperform from market perform Raymond James says the regional bank is well positioned.

CNBC: Investing

JULY 10, 2025

Investors are looking for opportunities in alternative asset managers and in cybersecurity. He added: "Post-election about six months ago, there was a lot of enthusiasm about these stocks on the view that higher asset prices and more capital markets activity like IPOs and M & A would boost these stocks. ET each day.)

CNBC: Investing

JULY 8, 2025

Its initial public offering earlier this year was the biggest technology IPO since 2021. " Citi analyst Tyler Radke said that the stock could face near-term downside as investors potentially opt to snag Core Scientific stock at a significant markdown. above CoreWeave's Monday close. As such, we view shares as fairly valued."

Cooley M&A

JANUARY 22, 2025

Portfolio optimization through divestitures of noncore assets In addition to pharmas smaller appetite in 2024, pharma companies continued to slim down by shedding nonessential assets to sharpen their strategic focus on core products.

CNBC: Investing

JULY 8, 2025

"While the situation remains fluid, we believe investors should be prepared for further devotion of resources (financial, time/attention) in the direction of Mr. Musk's political priorities, which may add further near-term pressure to TSLA shares," Jonas told clients in a 12-page report.

CNBC: Investing

JUNE 16, 2025

Analysts and investors say that may have been a little hasty. Meanwhile, Circle closed up 25%, still rallying on the heels of its wildly successful IPO the week before. Stablecoins provide a way to move the value of U.S. dollars using cryptocurrency rails instead of traditional banking rails.

CNBC: Investing

JUNE 26, 2025

The company went public to a great deal of fanfare in March of 2021 during the IPO bubble. data via Quartr) Like MELI and BABA before it, CPNG is executing a vertically integrated model that's powering both top-line expansion and margin improvement, and investors are pricing in that growth. Until now.

CNBC: Investing

JULY 1, 2025

Omada went public in early June, pricing its IPO at $19 per share. Analyst David Roman initiated coverage of Omada Health with a buy rating and 12-month price target of $29. That suggests roughly 58.5% potential upside ahead for the stock, which made its public debut on the Nasdaq on June 6. Since then, however, shares are down slightly.

Mergers and Inquisitions

MAY 14, 2025

Like renewable energy IB , different banks classify their groups differently, so you could find yourself working on everything from a data center REIT M&A deal to an airport financing to an IPO for a solar developer. However, they all relate to an assets ability to pay or repay its investors.

CNBC: Investing

JUNE 9, 2025

The company also maintains a strong balance sheet, with around $223 million in free cash flow, a quick ratio of approximately 2.7×, and increasing support from major institutional investors who are adding to their positions. CAH trades at an 18x forward PE and a 15x P/FCF - this thing is generating cash for investors. It has a 1.3%

CNBC: Investing

JULY 20, 2025

billion HKD ($610 million) on the exchange's busiest day ever for listings — five IPOs at once. " Lens Tech's latest listing follows a trend this year of more mainland Chinese companies going public in Hong Kong, which is easier for international investors to access. " U.S.

CNBC: Investing

JUNE 16, 2025

" Further, Cisco stock trades at a roughly 25% discount to the broader S & P 500, which represents an attractive entry point for investors, he said. " This outlook underpinned the stock upgrade, but he also pointed to "more favorable near-term competitive dynamics in networking and improved scale in security."

OfficeHours

OCTOBER 20, 2023

For private equity investors who have been monitoring the situation around inflation for the last few months to a year, many have been disappointed to see the slow trajectory with which inflation has been coming down from highs. Currently, inflation in the U.S. Explore the role of private equity now.

OfficeHours

OCTOBER 23, 2023

However, for private equity investors, this uncertainty represents a unique opportunity to take advantage of investment opportunities in public markets. According to the Institutional Investor, 81% of value in all transactions in 2023 so far were take-private deals (compared to 20% seen in a typical year).

OfficeHours

OCTOBER 16, 2023

For private equity investors who have been monitoring the situation around inflation for the last few months to a year, many have been disappointed to see the slow trajectory with which inflation has been coming down from highs. Currently, inflation in the U.S. Inflation can also impact a private equity firm’s exit strategy for an investment.

OfficeHours

JUNE 6, 2023

It has become a preferred choice for investors seeking attractive returns and diversification from traditional investment options such as stocks and bonds. VC investors provide capital to startups and small businesses in exchange for equity ownership. Venture capital focuses on early-stage companies with high growth potential.

Growth Business

OCTOBER 4, 2023

By Dom Walbanke on Growth Business - Your gateway to entrepreneurial success Atomico, one of Europe’s most active VC firms, has raised $1.1bn from investors, according to the Financial Times. Venture capital: Evaluating the risk profile of investments – How do VCs assess risk when looking forensically at investment portfolios?

How2Exit

APRIL 8, 2024

His diversified business portfolio includes marketing agencies, WordPress plugins, online courses, e-commerce businesses, and online content. rn As the discussion progresses, Wells shares his reflections on being the CEO of a public company post-IPO, the unexpected realities, and the learning curve that has come with the territory.

Growth Business

JUNE 1, 2023

By Brooks Newmark on Growth Business - Your gateway to entrepreneurial success The success of Dragons’ Den has long thrust angel investors into the spotlight, but away from the heat and drama of the den, angel investment is a crucial component of the UK start-up ecosystem. Don’t invest in someone who is a nice guy and seems smart.

Mergers and Inquisitions

OCTOBER 4, 2023

Oh, and lots of M&A , IPO , and SPAC deals were happening, so banks made plenty of “COVID hires,” often ignoring qualifications and recruiting norms. We never understand why these billionaires cared about GameStop or Redditors so much, given everything else in their lives and portfolios.

The Deal

OCTOBER 17, 2023

Direct-to-consumer businesses, darlings of the investor community in 2021, saw their techlike valuations plummet. But some subsectors, such as beauty, fragrance, residential services and medical spas, remained active as risk-off investors shifted deal activity toward categories they view as less discretionary, according to Leonhardt.

Mergers and Inquisitions

MAY 24, 2023

Here it is in the investor presentation: We don’t know the planned valuation for CMS in this spin-off, but let’s assume that Jacobs plans to spin it off at an IPO offering price that implies an 11.5x 5) Portfolio Concentration – Many special situations and distressed funds run concentrated portfolios (e.g.,

Mergers and Inquisitions

MARCH 13, 2024

This style is about purchasing minority stakes in cash-flow-negative-but-high-growth companies that want to scale and eventually go public or sell (think: Uber or Airbnb before their IPOs). There’s usually a long list of previous VC investors as well. In the 2010s, startups began to postpone their IPOs, but they still needed funding.

Wizenius

AUGUST 16, 2023

This intricate process involves optimizing tax efficiency, strategizing future cash flows tied to specific milestones, devising exit strategies encompassing exit valuations and considering various exit avenues such as IPOs or identifying potential buyers. The goal is to ensure comprehensive evaluation before advancing further.

Francine Way

JULY 8, 2017

Many of these causes have their equivalences to the reasons behind the sale of a company (also known as a divestiture): Liquidity: As the equity holding period matured, investors (private equity funds behind companies) will look to sell. Overlapping Product / Service Providers: strategic buyer, with 1 or more overlapping market segments.

Razorpay

AUGUST 9, 2023

Portfolio Management Merchant banking companies provide portfolio management services to high -net-worth individuals and corporate investors. These services include a selection of securities, portfolio monitoring and review, advice on the rationalization of portfolios, and tax planning.

CNBC: Investing

JUNE 16, 2025

" "We believe the stock will continue to trade higher this year as the Celsius brand returns to growth, the Alani Nu integration progresses smoothly, and investors look ahead to distribution expansion in 2026 and beyond." " "We recognize uncertainties about the Alani Nu brand longer-term," he added.

OfficeHours

AUGUST 9, 2023

As further discussed below, private equity firms raise funds from institutional investors and use these funds to acquire ownership stakes in businesses. Once improved, the exit can then take place, usually in the form of another sale or an Initial Public Offering (IPO), both of which are usually under the advice of an investment bank.

Growth Business

JULY 11, 2023

He should know; for his first venture he spent a year doing the rounds before successfully raising just over £1 million from legendary investor Jon Moulton (who rejected him the first time). Once you’ve made money for investors, it’s a different story.’ million can be raised by investors when they pool their resources,’ they said.

Mergers and Inquisitions

SEPTEMBER 20, 2023

Firm-Specific and Process Questions – What do you think about our portfolio? So, you could mention a related job, such as strategy, finance, or business development at a portfolio company, and say that you want to return to VC at a higher level eventually. Q: Tell me about the current IPO, M&A, and VC funding markets.

Mergers and Inquisitions

SEPTEMBER 11, 2024

Per FTI Consulting , solar, wind, and “portfolio” (mixed asset) deals account for 60% of renewable M&A activity in the U.S.: So, even if you’re advising entire companies, you must still be familiar with asset-level modeling and valuation and how an entire portfolio works. What Do You Do as an Analyst or Associate?

Growth Business

SEPTEMBER 4, 2023

This year, Octopus Ventures ’ Entrepreneurial Impact report found that 60 per cent of the top ten performers are based outside the golden triangle, with the University of Dundee topping the list – in part due to the £2.2bn IPO of AI drug discovery company Exscientia on the US NASDAQ, one of the largest ever UK university exits.

InvestmentBank.com

JANUARY 14, 2021

Jonathan Simnett from corporate law firm Hampleton Partners was reported saying, “[t]he brakes have been slammed on funding until investors are able to create maps to navigate uncharted territory” [4]. First, VC investors remained confident in their previous investments. These were just a few of many strong IPOs seen this year.

OfficeHours

AUGUST 20, 2023

As further discussed below, private equity firms raise funds from institutional investors and use these funds to acquire ownership stakes in businesses. Once improved, the exit can then take place, usually in the form of another sale or an Initial Public Offering (IPO), both of which are usually under the advice of an investment bank.

Chesapeake Corporate Advisors

AUGUST 16, 2024

These investors are attracted to well-run businesses with positive cash flows, a diverse customer base, and strong industry tailwinds. Businesses primed to take advantage of strategic growth opportunities (given sufficient capital) or operate in a fragmented market that is ripe for consolidation will be even more appealing to PE investors.

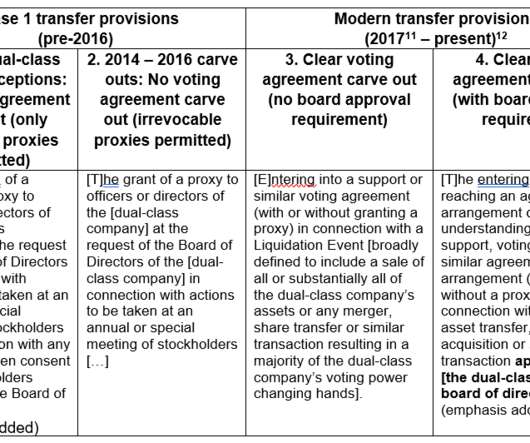

Cooley M&A

SEPTEMBER 16, 2022

There are compelling rationales for adopting a dual-class structure, but even proponents of the structure generally acknowledge that these benefits are significantly mitigated once the dual-class shares are out of the hands of the founders and/or pre-IPO stockholders. Potential carve outs for M&A voting agreements. Stockholder litigation.

Sun Acquisitions

SEPTEMBER 16, 2024

Take a strategic approach by assessing your business’s strengths, weaknesses, opportunities, and threats (SWOT analysis), identifying potential buyers or investors, and determining your desired exit timeline. Start early, ideally years before you intend to exit, to allow sufficient time for preparation and implementation.

Focus Investment Banking

APRIL 14, 2024

These characteristics, coupled with bakery manufacturers’ ability to continually innovate and adapt to consumer trends, have attracted investors and boosted M&A activity in recent years. Jim has worked on numerous IPOs, sell-side transactions, fairness opinions, and capital raises, mainly for consumer products companies and restaurants.

Growth Business

NOVEMBER 2, 2023

Unlike standard venture capital firms, CVCs work a lot closer with their portfolio companies in developing a particular technology that is beneficial to both parties. It is interested in companies at pre-Series A through to pre-IPO stage. Here, we list active CVCs in the UK, what they look for and how much they invest.

Growth Business

SEPTEMBER 13, 2023

However, the reality is that many venture capital investors are playing it cautious, wanting to invest in later, safer funding rounds for companies with proven revenue. Ascension Ventures Mini bio: Ascension Ventures is one of the most active seed investors in the UK. of successful exits: N/A Website: www.antler.co

Mergers and Inquisitions

JULY 31, 2024

Today, you could put most private equity activity in industrials into a few main categories: Consolidation / Roll-Up Plays – The idea is to acquire smaller companies to consolidate the parent company’s market position and become more appealing in an eventual IPO or M&A deal.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content