Synthetic W&I Insurance: Broadening Warranty Protection in M&A

JD Supra: Mergers

JUNE 20, 2025

Warranty & indemnity ("W&I") insurance is playing an increasingly important role in M&A transactions.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JUNE 20, 2025

Warranty & indemnity ("W&I") insurance is playing an increasingly important role in M&A transactions.

Focus Investment Banking

MARCH 10, 2025

This target is negotiated and agreed upon, and the investment banking advisor will play a large role here. Clearly break out expenses (insurance broken out by auto, health; salaries broken out by owner, employee; and so on.) Obviously, this doesnt fly with the buyer three days before close. product, service and sales channel).

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

iMerge Advisors

APRIL 15, 2025

Cyber Insurance Policies Coverage details, limits, and exclusions related to data breaches or regulatory fines. The earlier you build this into your operating model, the more leverage youll have when its time to negotiate. Incident Logs A record of past security incidents, how they were handled, and what changes were made afterward.

Cooley M&A

JANUARY 22, 2025

For acquisitions of clinical-stage companies, this also reflects an increased appetite by buyers for companies with recent data readouts of later-stage trials, resulting in a relatively de-risked regulatory approval runway.

Razorpay

JUNE 24, 2025

Originally launched as a community-led edtech initiative under the Finance With Sharan brand, it has since evolved into a full-stack financial services provider , spanning education, SEBI-registered investment advisory, insurance advisory, credit card advisory, financial products, and more.

Focus Investment Banking

JUNE 24, 2025

Once we learn how to write the repair plan, then we were in a position to learn how to negotiate to get paid. So we’re going to do that and then we’re going to advocate to get compensated as best we can to prove to our insurance folks that, hey, this is necessary, It’s not included. What’s it worth?

JD Supra: Mergers

SEPTEMBER 5, 2024

Representations and warranties insurance (RWI) has become an increasingly common feature in mergers and acquisitions (M&A) transactions, serving as a risk management tool for both buyers and sellers. By: DarrowEverett LLP

Focus Investment Banking

JULY 31, 2025

And then I got to negotiate the price of the car. And then the insurance carriers are trying to figure out how we insure these things, right? You know, who’s going to insure the vehicle. And you know, so there are a whole bunch of down and then health, health insurance too, right? They would just circulate.

JD Supra: Mergers

MAY 1, 2025

Negotiating a basket mechanism into your merger or acquisition agreement? One of the questions it pays to ask (and answer) early on is how that basket mechanism will function with the retention amount you will be negotiating into your representations and warranties insurance (RWI) policy. By: Woodruff Sawyer

JD Supra: Mergers

SEPTEMBER 9, 2024

Rather than considering an adjustment to the purchase consideration, negotiating an indemnity/escrow, self-insuring the risk. By: Ankura

JD Supra: Mergers

SEPTEMBER 4, 2024

In most M&A transactions, after the parties have negotiated the basic commercial terms, they then negotiate the warranties and indemnities (W&I). Generally, buyers want the anticipated value of their purchase without any surprises after the deal closes.

JD Supra: Mergers

AUGUST 24, 2023

On December 4, 2019, the insured media company merged with another media company. Stockholders brought several lawsuits challenging the merger and asserted claims for breach of fiduciary duty against the insured’s directors, officers, and controlling stockholders for their roles in negotiating and. By: Wiley Rein LLP

JD Supra: Mergers

NOVEMBER 1, 2024

In the context of representations & warranties insurance (RWI), this change means that the interim period between a deal’s sign and close will likely also grow longer, requiring deal parties to negotiate for a longer interim breach coverage period in their RWI policies. By: Woodruff Sawyer

JD Supra: Mergers

JUNE 5, 2024

The Study looks at several areas of negotiation, including financial terms, pervasive qualifiers, representations and warranties, covenants, closing conditions, indemnification provisions, and representations and warranties insurance. By: Goulston & Storrs PC

How2Exit

OCTOBER 14, 2024

The importance of clean data rooms, strategic earn-out agreements, and the role of rep and warranty insurance in private transactions forms the crux of their discussion. Understanding Earn-Outs : Earn-out agreements should be negotiated meticulously, with clear metrics and expectations to ensure they serve both parties' interests.

Sica Fletcher

SEPTEMBER 17, 2024

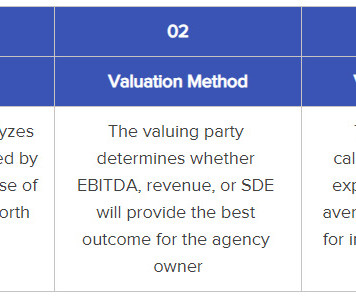

When insurance agency sellers have already met with prospective buyers, they may have been offered a valuation based on their “adjusted EBITDA.” The following article provides a brief overview of EBITDA and adjusted EBITDA valuations for insurance agencies. What Is EBITDA? What Is Adjusted EBITDA?

Sun Acquisitions

FEBRUARY 3, 2023

Negotiating the sale of a manufacturing business can be highly stressful, but it is possible to get through it with minimal stress when armed with the right tips and strategies. To help ensure a better outcome for all parties involved, here are some top tips for negotiating the sale of a manufacturing business.

The New York Times: Mergers, Acquisitions and Dive

MAY 1, 2023

The resolution of First Republic Bank came after a frantic night of deal making by government officials and executives at the country’s biggest bank.

Sica Fletcher

SEPTEMBER 12, 2024

Although insurance agencies are not always family affairs, the 2024 insurance landscape reveals that between 50% and 70% of agencies are family-owned. The valuation process has a few additional considerations when selling a family insurance agency. In particular, sellers should be aware of: Family Reputation as an Asset.

Sica Fletcher

APRIL 30, 2024

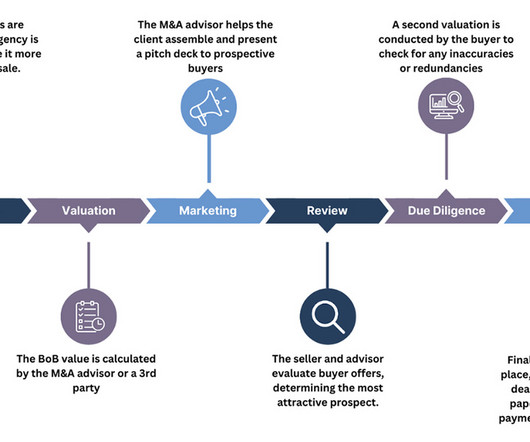

This article presents a step-by-step guide on how to value an insurance agency - both in the sense of how a valuation agency/M&A advisor goes about valuation, and also in terms of what insurance agency owners can do to maximize their valuation prior to running an M&A deal.

Sica Fletcher

SEPTEMBER 3, 2024

The following article details the process of selling an insurance agency book of business in 2024, including deviations from the process of selling an agency, the valuation process, and common payout structures. Selling an insurance agency book of business has a few advantages over selling the agency in total. Why Sell Just the Book?

Sica Fletcher

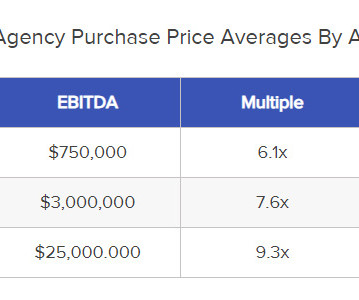

JUNE 14, 2024

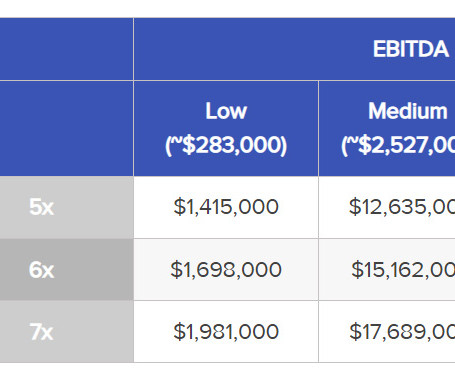

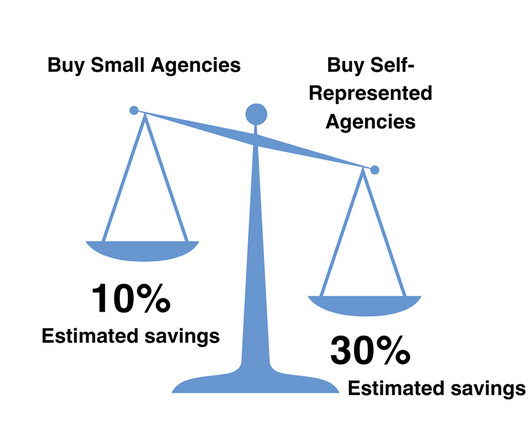

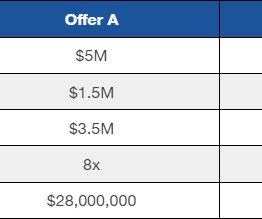

Insurance agency owners who are considering the prospect of running an M&A deal process often have many concerns about the fate of their agencies, but the most common by far are those surrounding the agency’s purchase price at closing. We’ll also detail some of the factors affecting these calculations.

Sica Fletcher

APRIL 2, 2024

The following report examines the health and outlook for insurance M&A deals in 2024. We base this research on several key findings in our proprietary SF database, which observes and records data from the top ~400 insurance M&A buyers. Agency vs. Company: Which Is The Better Insurance M&A Deal?

Sica Fletcher

JULY 2, 2024

For agency owners looking to sell their business in 2024, it’s helpful to know something about the insurance M&A buyer landscape before going in. The following section details the insurance M&A buyer landscape as of Q3 2024. To provide a sense of context for buyers’ current standing, we also include information from 2023.

Sica Fletcher

JUNE 11, 2024

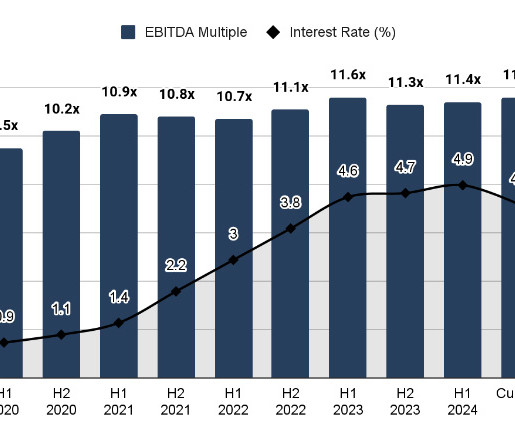

The following report contains our projections for Q3 2024 insurance broker valuation multiples. In addition, we categorize this data according to insurance industry specialization and by brokerage size, as measured by their annual revenue. Since H1 2023, the average insurance brokerage valuation multiple has hovered around 11.6x

Sica Fletcher

MAY 15, 2024

This article breaks down the question, “how much is my insurance agency worth” in further detail, but the table below provides a surface-level overview based on varying degrees of revenue and operating expense: How Much Is My Insurance Agency Worth: A Breakdown Answering the question, “how much is my insurance agency worth?”

Sica Fletcher

MARCH 12, 2024

As one of the most active M&A firms in the insurance sector, we are frequently asked how insurance agency valuations work. This article discusses the fundamentals of insurance agency valuations, plus a few lesser-known factors that play into these processes before we give an overview of the insurance M&A market in 2024.

What's Market

SEPTEMBER 6, 2022

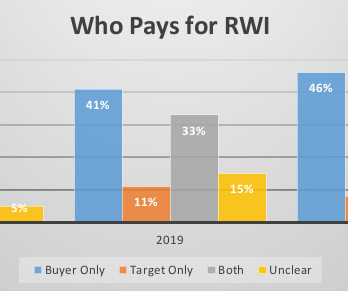

The most recent three of these studies (2017, 2019 and 2021) have looked at representation and warranty insurance (“RWI”) in private company M&A transactions. With RWI, buyers and sellers are able to allocate some of the post-closing M&A indemnity risk to third party insurers.

Sica Fletcher

MARCH 26, 2024

This article outlines how to sell an insurance agency by chronological steps, with a quick overview of the process in the table immediately following. We also include some key insights we’ve gathered over several decades of selling insurance agencies. Insurance agency M&A transactions take one of two forms: Auction.

Sica Fletcher

JULY 31, 2024

The 2024 insurance M&A market has changed substantially from just a few years ago, with potentially staggering implications for the future of insurance M&A transactions. Insurance M&A Transactions in 2024 The insurance M&A transactions we have observed thus far in 2024 indicate larger trends in the sector.

Cooley M&A

MAY 23, 2024

While representation and warranty (R&W) insurance continues to be used across a broad range of M&A transactions, its use has cooled as dealmakers navigate challenging market conditions. As deal flow has dwindled, competition has increased among carriers, and minimum floors largely have fallen away. of the policy limit.

Sica Fletcher

JULY 23, 2024

In it, we provide readers with a quick and simple overview of the current insurance brokerage M&A market , after which we discuss several macroeconomic and industry-specific factors that could drastically affect transactions in the next six months. The market is already highly competitive, but it’s also limited to what buyers can afford.

Sica Fletcher

JUNE 20, 2024

The insurance M&A market in 2024 is significantly more complex now than it was 20 years ago. However, this report seeks to make sense of these qualities as a whole to provide an overview of the 2024 insurance M&A market. for insurance agencies.

Cooley M&A

DECEMBER 3, 2019

Over the last decade the use of R&W insurance in merger and acquisition transactions has grown exponentially. From 2008 to 2018, the total R&W policies bound per year in North America rose from 40 deals, providing $541 million of coverage to 1500+ R&W insurance transactions, providing aggregate coverage of $38.6 Advantages.

iMerge Advisors

APRIL 14, 2025

Even after months of diligence, negotiation, and documentation, the final 5% of the deal often requires 50% of the effort. At iMerge, weve advised on hundreds of software and technology transactions, and weve seen firsthand how last-minute negotiations can either derail a deal or solidify a successful exit. tax, IP) survive post-close?

The M&A Lawyer

SEPTEMBER 8, 2015

A substantial amount of the time and energy involved in papering and negotiating the deal is usually devoted to reps and warranties. Parties are well-served to remember this risk-shifting function during negotiations. Why do representations and warranties get so much attention? Reps serve four primary functions. Disclosure. guarantees.

Sica Fletcher

DECEMBER 16, 2020

Every year, numerous insurance agency and broker principals attempt to sell their companies by being " Serial Daters". They are contacted by a potential buyer or solicited by someone who has sold their agency and try to negotiate with one buyer at a time. This is generally a very big mistake.

How2Exit

MARCH 24, 2023

To do this, he obtained his insurance and securities licenses and started helping developers raise money. Concept 9: Negotiate Creative Deals Negotiating creative deals is a key component of successful acquisitions. Whether it is a purchase or a merger, the negotiation process can be complex and requires careful consideration.

OfficeHours

AUGUST 25, 2023

The buyer universe for this debt most often includes collateralized loan obligation (“CLO”) funds, high-yield mutual funds, insurance companies, and other similar institutional buyers. Second, private credit investors are able to provide substantially more flexibility for borrowers.

How2Exit

MARCH 1, 2023

Joel believes that a lot of the stuff that people uncover during the negotiation process should have been known before the negotiations process. Finally, creative insurance products may also be available, but this is an area that requires expert advice and research. Bringing a lawyer in too early can be a mistake.

Lake Country Advisors

JULY 25, 2024

Review insurance coverage. Final Steps and Decision Making The final steps in the due diligence process involve summarizing findings, negotiating terms, and preparing for the transition post-acquisition. The report will keep your key stakeholders informed and guide negotiations. Negotiate the terms and conditions.

Francine Way

MAY 14, 2017

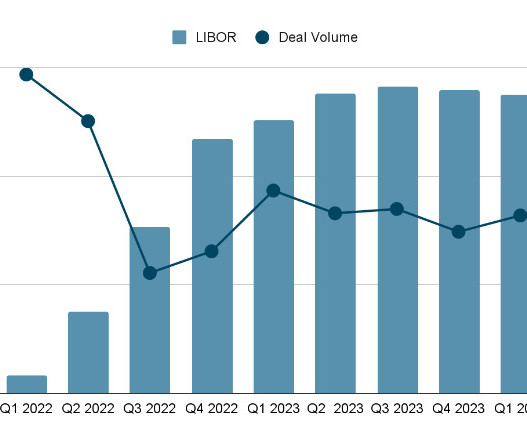

They can be prepaid based on negotiation, and this flexibility comes with an attractive pricing (LIBOR + 300-350 bps). Mezzanine or Sub Debt: Varies in size (smallest would be $5M), 7-10 years with no amortization (balance paid at maturity), unsecured, and provided by insurance companies, pension funds, and mezzanine private / public funds.

Beyond M&A

SEPTEMBER 13, 2023

The usual suspects I assume the ‘standard’ checkpoints are often the first ports of call: scope, timing, pricing, customer references, technical certifications, vendor partnerships, SLAs, insurance details, system uptime, and response times. An assurance of swift support response is non-negotiable. Ask for evidence.

How2Exit

MAY 8, 2023

Once the evaluation is complete, the buyer and seller must then negotiate the terms of the transaction. This negotiation process can be complex and may involve the use of lawyers, accountants, and other professionals. Once the due diligence is complete, the buyer and seller must then negotiate the purchase price.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content