Synthetic W&I Insurance: Broadening Warranty Protection in M&A

JD Supra: Mergers

JUNE 20, 2025

Warranty & indemnity ("W&I") insurance is playing an increasingly important role in M&A transactions.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JUNE 20, 2025

Warranty & indemnity ("W&I") insurance is playing an increasingly important role in M&A transactions.

Cooley M&A

JANUARY 22, 2025

That said, Andrew Ferguson, Trumps proposed chair of the FTC, is self-proclaimed to be pro-business, promising to [s]top Lina Khans war on mergers as [m]ost mergers benefit Americans and promote the movement of the capital that fuels innovation.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

JD Supra: Mergers

SEPTEMBER 5, 2024

Representations and warranties insurance (RWI) has become an increasingly common feature in mergers and acquisitions (M&A) transactions, serving as a risk management tool for both buyers and sellers. By: DarrowEverett LLP

JD Supra: Mergers

MAY 1, 2025

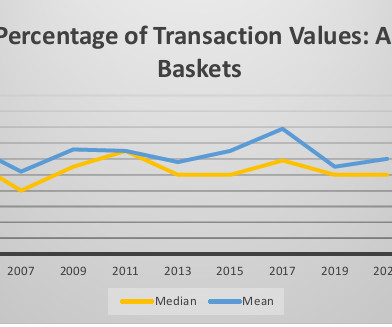

Negotiating a basket mechanism into your merger or acquisition agreement? One of the questions it pays to ask (and answer) early on is how that basket mechanism will function with the retention amount you will be negotiating into your representations and warranties insurance (RWI) policy. By: Woodruff Sawyer

JD Supra: Mergers

SEPTEMBER 9, 2024

Rather than considering an adjustment to the purchase consideration, negotiating an indemnity/escrow, self-insuring the risk. By: Ankura

JD Supra: Mergers

JUNE 5, 2024

The Private Target Mergers & Acquisitions Deal Points Study (“the Study”) is published on a bi-annual basis by the Market Trends Subcommittee of the ABA Business Law Section’s M&A Committee, which I am happy to serve on. By: Goulston & Storrs PC

JD Supra: Mergers

AUGUST 24, 2023

On December 4, 2019, the insured media company merged with another media company. Stockholders brought several lawsuits challenging the merger and asserted claims for breach of fiduciary duty against the insured’s directors, officers, and controlling stockholders for their roles in negotiating and. By: Wiley Rein LLP

JD Supra: Mergers

SEPTEMBER 4, 2024

In most M&A transactions, after the parties have negotiated the basic commercial terms, they then negotiate the warranties and indemnities (W&I). Generally, buyers want the anticipated value of their purchase without any surprises after the deal closes.

JD Supra: Mergers

NOVEMBER 1, 2024

In the context of representations & warranties insurance (RWI), this change means that the interim period between a deal’s sign and close will likely also grow longer, requiring deal parties to negotiate for a longer interim breach coverage period in their RWI policies. By: Woodruff Sawyer

How2Exit

OCTOBER 14, 2024

E248: Setting Yourself Up for Success: Essential Steps, Tips, and Strategies for a Profitable Exit - Watch Here About the Guest(s): Kip Wallen is a seasoned M&A attorney with over a decade of experience in live mergers and acquisitions deals, primarily within the lower middle market, involving transactions up to $50 million.

The New York Times: Mergers, Acquisitions and Dive

MAY 1, 2023

The resolution of First Republic Bank came after a frantic night of deal making by government officials and executives at the country’s biggest bank.

What's Market

SEPTEMBER 6, 2022

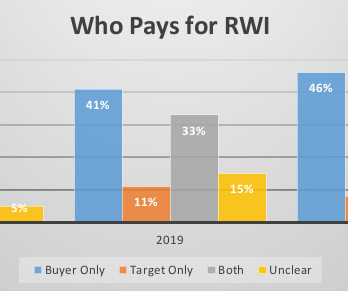

Market Trends: What You Need to Know RWI is an increasingly important feature of private company merger and acquisition transactions. Every other year since 2005 the ABA has released its Private Target Mergers and Acquisitions Deal Points Studies (the “ABA studies”).

Focus Investment Banking

OCTOBER 7, 2024

Mergers & Acquisitions For Dummies provides useful techniques and real-world advice for anyone involved with – or thinking of becoming involved with – transactional work. If you’re getting involved with a merger or an acquisition, this book will help you gain a thorough understanding of what the heck is going on.

Cooley M&A

MAY 23, 2024

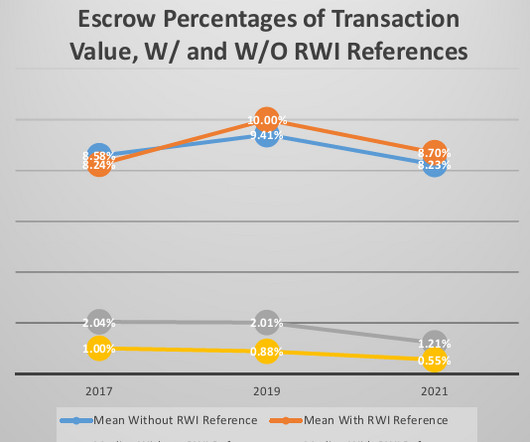

While representation and warranty (R&W) insurance continues to be used across a broad range of M&A transactions, its use has cooled as dealmakers navigate challenging market conditions. As deal flow has dwindled, competition has increased among carriers, and minimum floors largely have fallen away. of the policy limit.

How2Exit

MAY 8, 2023

Ron Concept 1: Explore Business Acquisitions and Mergers Business acquisitions and mergers are an increasingly popular way for entrepreneurs to grow their businesses and increase their profits. Acquisitions and mergers allow businesses to expand into new markets, increase their customer base, and take advantage of economies of scale.

Cooley M&A

SEPTEMBER 16, 2024

Just like the romantic union of global pop superstar Taylor Swift and Super Bowl champion Travis Kelce, in the business world, combinations of similarly sized companies – or so-called mergers of equals – can yield positive benefits if executed with care [1]. Call it what you want – defining a merger of equals transaction and process 1.

Cooley M&A

DECEMBER 3, 2019

Over the last decade the use of R&W insurance in merger and acquisition transactions has grown exponentially. From 2008 to 2018, the total R&W policies bound per year in North America rose from 40 deals, providing $541 million of coverage to 1500+ R&W insurance transactions, providing aggregate coverage of $38.6

iMerge Advisors

APRIL 14, 2025

Even after months of diligence, negotiation, and documentation, the final 5% of the deal often requires 50% of the effort. At iMerge, weve advised on hundreds of software and technology transactions, and weve seen firsthand how last-minute negotiations can either derail a deal or solidify a successful exit. tax, IP) survive post-close?

Sun Acquisitions

MARCH 29, 2024

In the world of mergers and acquisitions (M&A), seller financing deals can offer numerous benefits to buyers. Negotiate favorable terms that align with your business’s cash flow and profitability. This could involve risk insurance, contingency plans, or renegotiating the financing terms.

How2Exit

MAY 20, 2024

b' E213: Ujwal Velagapudi: Buying Unique Businesses and Building a Diverse Portfolio - Watch Here rn rn About the Guest(s): rn Ujwal Velagapudi is a seasoned entrepreneur with a rich background in mergers and acquisitions, real estate investments, and a vast array of business ventures across multiple industries.

How2Exit

MARCH 1, 2023

Joel believes that a lot of the stuff that people uncover during the negotiation process should have been known before the negotiations process. Finally, creative insurance products may also be available, but this is an area that requires expert advice and research. Bringing a lawyer in too early can be a mistake.

How2Exit

MARCH 24, 2023

To do this, he obtained his insurance and securities licenses and started helping developers raise money. Concept 9: Negotiate Creative Deals Negotiating creative deals is a key component of successful acquisitions. Whether it is a purchase or a merger, the negotiation process can be complex and requires careful consideration.

Lake Country Advisors

JULY 25, 2024

Review insurance coverage. Final Steps and Decision Making The final steps in the due diligence process involve summarizing findings, negotiating terms, and preparing for the transition post-acquisition. The report will keep your key stakeholders informed and guide negotiations. Negotiate the terms and conditions.

What's Market

AUGUST 22, 2022

Introduction In merger and acquisition (M&A) transactions, the definitive purchase agreement, whether asset purchase agreement, stock purchase agreement, or merger agreement, typically contains representations and warranties made by the seller with respect to the target company.

What's Market

AUGUST 29, 2022

Market Trends: What You Need to Know As shown in the American Bar Association's Private Target Mergers and Acquisitions Deal Points Studies: Indemnity escrows are consistently seen in about two-thirds or more of reported transactions.

The M&A Lawyer

AUGUST 25, 2015

Most private M&A transactions are structured as acquisitions of stock , rather than mergers or asset purchases. Some, such as “Liabilities,” “Material Adverse Effect” or “Seller’s Knowledge” (or their equivalents) are used throughout the contract and may be the subject of extensive negotiations.

Sun Acquisitions

MAY 24, 2024

Mergers and acquisitions (M&A) are intricate transactions that demand careful attention to various legal considerations. While the basics of due diligence and contract negotiations are vital, there are less commonly discussed legal aspects that can significantly impact the success and sustainability of M&A deals.

What's Market

SEPTEMBER 26, 2022

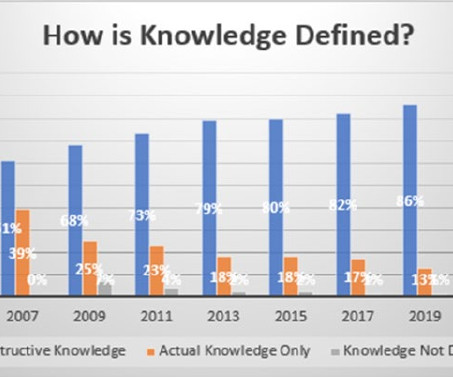

Market Trends: What You Need to Know As reflected in the American Bar Association's Private Target Mergers and Acquisitions Deal Points Studies: “Knowledge” is now almost always defined in private company transaction agreements. The parties must still negotiate the scope of the seller's knowledge.

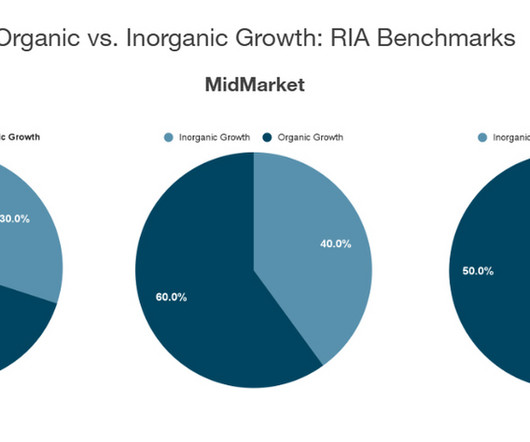

Sica Fletcher

OCTOBER 16, 2024

growth from acquisitions, mergers, or partnerships with other RIAs). The essential takeaway from these insights is that the 2024/2025 market will be a great time to sell an RIA, but sellers should be prepared for a lengthy deal process full of complex negotiations.

RKJ Partners

AUGUST 6, 2017

This insures that you will not need to start the process over again should negotiations terminate for any reason with a lead acquirer. Should sellers negotiate with more than one buyer simultaneously? Working with an investment banker better enables a seller to actively negotiate with numerous buyers independently.

Sun Acquisitions

FEBRUARY 3, 2023

by purchasing a controlling stake and turning your business into a subsidiary), take over completely as in a merger and acquisition, or want to diversify into other markets. And speaking of lawyers… 4. Negotiating the Sale Once your business enters the market, it’s only a matter of time before you start receiving offers.

Cooley M&A

AUGUST 30, 2019

Call it a compromise, call it delayed gratification, but do not call it simple: earn-out payments often give rise to disputes because the interpretation of what qualifies as the achievement of previously negotiated milestones can differ wildly once viewed through the muddied lens of time. In Windy City Investments Holdings, LLC v.

Sun Acquisitions

JUNE 15, 2022

Business valuation is a mandatory function required during litigation, mergers and acquisitions, and investment analysis. This in turn allows you to price correctly, negotiate confidently, and settle on a just amount. Check out these links: Mitigating Post-Closing Risks Through The Rep and Warranty Insurance.

What's Market

SEPTEMBER 12, 2022

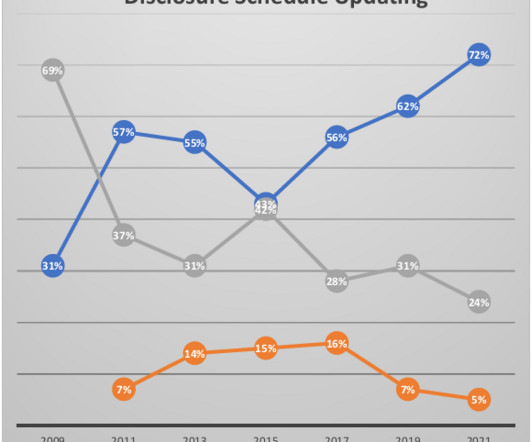

Introduction Disclosure schedules are a common component of an M&A purchase agreement (whether a stock purchase agreement, asset purchase agreement, or merger agreement). Buyers and rep and warranty insurers are focusing more aspects of their due diligence on virus-related matters. These results are set forth below.

Sun Acquisitions

MAY 26, 2022

Brokers who specialize in mergers and acquisitions have access to an extensive network of buyers – one that’s often curated and can’t be found anywhere else. Check out these links: Mitigating Post-Closing Risks Through The Rep and Warranty Insurance. M&A Brokers. Online Listing Websites. Contact us today.

Cooley M&A

OCTOBER 25, 2018

When parties execute a letter of intent in connection with an acquisition, they enter into a binding agreement to negotiate in good faith the terms set out in the letter. There is no positive obligation to negotiate in good faith. No individual stockholder of the seller has to be a party to the merger agreement.

Devensoft

JUNE 1, 2023

Chapter 1: A Modern Due Diligence Guide for Today’s Economy Merger and acquisition (M&A) due diligence is a crucial process for businesses looking to acquire or merge with another. It helps the acquiring company to make informed decisions and negotiate the deal’s terms and conditions. Don’t have time to read it now?

Focus Investment Banking

JUNE 13, 2023

Similarly, PE-backed platform companies have undergone substantial consolidation through mergers and acquisitions.” With all the changing insurance relationships and the cost of doing business on a day-to-day basis, that's a pretty risky proposition,” he said. There are now 23 PE-backed platform companies, Milligan said.

What's Market

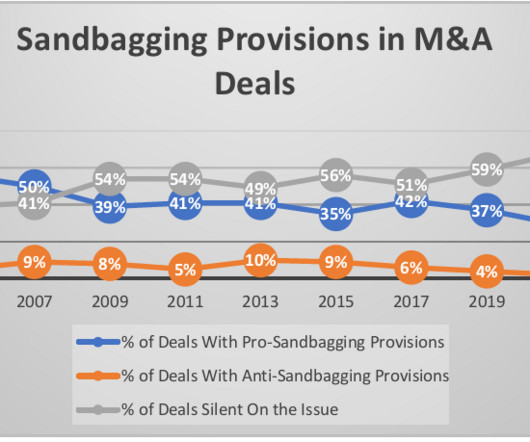

SEPTEMBER 19, 2022

Market Trends: What You Need to Know “Sandbagging” concepts are often the subject of intense negotiation in M&A transactions. does a passing comment by the company's president about an employment issue as the buyer's team is rushing to grab a taxi after a full day's negotiation impart knowledge of that issue?

IBG

JANUARY 31, 2023

For someone considering a merger or the purchase of a business, document review and the answers to due-diligence questions are critical. It is very common for problems and issues to pop up during due diligence, so it’s important to stay proactive and be open to negotiation until the deal is finalized.”

InvestmentBank.com

OCTOBER 24, 2019

With larger physician networks and access to specialist’s hospitals also gain negotiating leverage with insurers and can participate in alternative payment models, such as capitated and bundled payments, through vertical integration. Christopher Majdi, Director of Valuation & FMV Services at Premier, Inc. Down from 25.8%

Devensoft

AUGUST 24, 2023

By melding the proficiencies, assets, and potentials residing within distinct business sectors or entities under a single organizational umbrella, the practice of mergers and acquisitions unveils dormant possibilities, propels inventive evolution, and champions the delivery of unparalleled outcomes. Short on time? Limited on time?

Cooley M&A

JANUARY 24, 2020

Thereafter, plaintiffs’ counsel often demands a “mootness fee” (for the alleged benefit conferred by the supplemental disclosures), over which the parties can negotiate or litigate, if necessary.

Mergers and Inquisitions

SEPTEMBER 20, 2023

A: For this one, you should find highly specific markets – such as P&C insurance technology rather than “fintech” – and argue that others have overlooked them for reasons X, Y, and Z, but they could potentially create billion-dollar startups. The ownership is clear, but priced rounds take longer to negotiate and may be more expensive.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content