Managing Litigation Risk During the Business Lifecycle, Part 4: M&A Transactions with Government Contractors

JD Supra: Mergers

JUNE 11, 2025

Transactions that involve government contracts carry a unique set of challenges.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

JD Supra: Mergers

JUNE 11, 2025

Transactions that involve government contracts carry a unique set of challenges.

JD Supra: Mergers

JUNE 10, 2025

Mergers and acquisitions (M&A) involving government contractors present unique challenges and considerations that require meticulous due diligence. government. This blog post outlines some of the basic best practices for due diligence when acquiring or selling a business that performs U.S.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How2Exit

MARCH 10, 2025

E271: How This Dealmaker Closes a Business Acquisition Every Week—WITHOUT Using His Own Money! With decades of experience in technology, business acquisitions, and rollups, Richmond has developed a reputation for structuring creative and sustainable deals. The Fastest Way to Exit?

PCE

JUNE 9, 2025

Industry Trends Largest Transactions Closed Target Buyer Value($mm) Please Share This Tweet Share Pin It Share RELATED RESOURCE PCE Names Valuation Practice Leader Read now RELATED RESOURCE Resource Title goes here Read now PCE Investment Bankers, Inc. You can depend on us to deliver maximum results.

How2Exit

AUGUST 2, 2023

With over 15 years of experience in the technology industry, Kurt has a deep understanding of how technology applies to mergers and acquisitions. rn Summary: rn Kurt Stein discusses the role of technology, specifically artificial intelligence (AI), in mergers and acquisitions. Let's dive in.

Sun Acquisitions

MARCH 27, 2024

In today’s business landscape, mergers and acquisitions (M&A) are not just about profit and market share. Companies increasingly recognize the importance of Environmental, Social, and Governance (ESG) factors in shaping their strategic decisions. Deal Structuring: ESG factors are influencing deal structuring.

MergersCorp M&A International

DECEMBER 2, 2024

New York, NY – The Korea Trade-Investment Promotion Agency (KOTRA) in New York is excited to announce its strategic partnership with MergersCorp M&A International, an american leading investment banking and advisory firm specializing in mergers and acquisitions (M&A) and corporate finance. As the U.S.

Software Equity Group

SEPTEMBER 19, 2023

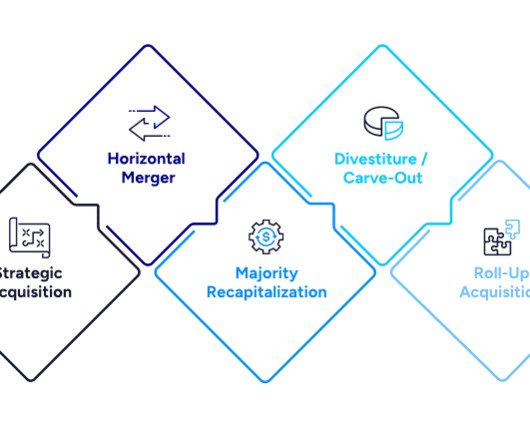

Overall, this has resulted in a significant increase in software mergers and acquisitions in recent times. There are many types of mergers and acquisitions, each of which may be structured to achieve varying goals. Not all M&A deals are equal. Assuming the company continues to grow and thrive under its new structure.

Equiteq

SEPTEMBER 11, 2024

In the ever-evolving landscape of Environmental, Social, and Governance (ESG) consulting, the recent Equiteq report sheds light on significant trends, valuations, and mergers and acquisitions (M&A) activity.

Sun Acquisitions

APRIL 18, 2024

Sun Acquisitions announces its latest sell-side engagement, representing a well-established catering business in operation for over 30 years and based in Illinois. Sun Acquisitions, a renowned mergers and acquisitions firm based in Chicago, will oversee the sell-side engagement which will be led by senior advisor Kevin Collins.

The Harvard Law School Forum

MAY 3, 2023

Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? This post is based on their Wachtell Lipton memorandum. discussed on the Forum here ) by John C. Current Developments A.

MergersCorp M&A International

DECEMBER 9, 2024

The Maltese Government has also implemented various gaming regulations that are conducive to business, allowing for a streamlined licensing process. Additionally, the Government’s proactive approach in promoting foreign direct investment has created a positive business climate.

Peak Frameworks

MAY 2, 2024

Understanding Vertical Mergers A vertical merger involves a company integrating with another that operates within its own supply chain, either upstream (suppliers) or downstream (distributors). Anti-trust Issues: Especially in North America, regulatory scrutiny can delay or derail mergers that significantly alter market dynamics.

Solganick & Co.

APRIL 24, 2024

Solganick Technology Services M&A Update – Q1 2024 Final April 25, 2024 – Los Angeles and Dallas – Solganick & Co. (“Solganick”) has issued its latest technology services industry sector mergers and acquistions (M&A) update report for Q1 2024.

Viking Mergers & Acquisitions

MAY 25, 2023

Find a Dependable Broker Advisor When selling a small business, a good business advisor is your ally from valuation to closing. Understand the Business’s Value A valuation analyzes a business for its financial worth. Read more about our business valuation process in this blog post.)

Cooley M&A

SEPTEMBER 16, 2024

Just like the romantic union of global pop superstar Taylor Swift and Super Bowl champion Travis Kelce, in the business world, combinations of similarly sized companies – or so-called mergers of equals – can yield positive benefits if executed with care [1]. Call it what you want – defining a merger of equals transaction and process 1.

Midaxo

APRIL 25, 2023

How to develop an acquisition strategy? How to outline the process for negotiating deal terms and determining valuation? Develop an acquisition strategy : Outline the criteria for target companies, including size, industry, geographic location, technology, and customer base. How to create a target identification process?

Sun Acquisitions

AUGUST 5, 2024

In the dynamic world of mergers and acquisitions (M&A), staying ahead of the curve is crucial for success. Technology enables more efficient due diligence, valuation, and integration, helping companies identify opportunities and mitigate risks more effectively.

The Harvard Law School Forum

JUNE 16, 2023

Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? Even in deals that ultimately do not include CVRs, they are frequently being discussed behind the scenes by buyers and sellers as a way to address a lack of alignment on valuation.

Mergers and Inquisitions

OCTOBER 30, 2024

Better transition roles for moving into IB/PE/related fields are corporate banking , Big 4 TS/TAS/valuation , credit analysis , or even commercial real estate or management consulting. For example, in corporate development, you spend time evaluating potential acquisitions and partnerships/joint ventures with other firms.

Sun Acquisitions

NOVEMBER 7, 2022

As can be imagined, selling a business encumbered by a government loan requires you to tread cautiously. As the PPP borrower, you’re obliged to inform the PPP lender of the planned merger or acquisition in writing. If you’re thinking of selling your business, contact us at Sun Acquisitions. The PPP Loan. The PPP Note.

The Harvard Law School Forum

SEPTEMBER 22, 2022

Either way, buyers dependent on acquisition financing will need to adjust for this accordingly—potentially, by using their cache of dry powder to write larger equity checks. Leveraged loans and high-yield bonds are at the riskier end of the curve, and PE firms rely heavily on this financing. more…).

Mergers and Inquisitions

MAY 14, 2025

Infrastructure Investment Banking Definition: In infrastructure investment banking, bankers advise companies in the data center, renewables, transportation, utilities, and energy storage/transportation markets on equity and debt issuances, asset deals, and mergers and acquisitions. Treasuries, its less impressive.

Mergers and Inquisitions

MARCH 13, 2023

In 24 hours, it went from “We’re fine, but we took some losses and need additional capital” to “The FDIC is taking over, the government has guaranteed uninsured deposits, and there might be additional bank runs and a financial crisis or three.” If you’re familiar with bank accounting, valuation, and regulatory capital (i.e.,

Cooley M&A

MARCH 22, 2023

With the US initial public offering markets continuing to remain largely closed, and special purpose acquisition company combinations being costly and complex, there’s a new kid in town for foreign companies looking to go public in the US: reverse mergers. Some reverse mergers involving a U.S.

Devensoft

JUNE 14, 2023

We understand that mergers and acquisitions (M&A) deals are complex and multifaceted. However, in recent years, there has been a growing recognition that Environmental, Social, and Governance (ESG) factors should also be part of the due diligence process. ESG factors can impact the valuation of a target company.

MergersCorp M&A International

OCTOBER 15, 2024

In a significant move to capitalize on the burgeoning Special Purpose Acquisition Company (SPAC) market, MergersCorp has announced the launch of specialized services tailored specifically for SPACs. These services are designed to address the complexities that SPACs face in a continually evolving regulatory environment.

How2Exit

JULY 3, 2023

Ron Concept 1: Specializing In Business Acquisitions And Mergers Business acquisitions and mergers are complex processes that require careful planning, strategic decision-making, and expert guidance. The role of a business advisor in the context of acquisitions and mergers is multifaceted.

Mergers and Inquisitions

SEPTEMBER 11, 2024

The bad news is that despite these positives, it’s still highly dependent on the government and overall macro conditions – despite claims to the contrary. Operating metrics and valuation multiples , especially for the assets and companies that are the most different (see below). What Do You Do as an Analyst or Associate?

Sun Acquisitions

OCTOBER 9, 2024

In the dynamic landscape of mergers and acquisitions (M&A), the intricacies of family business succession planning often need to be addressed. Moreover, issues related to governance, leadership succession, and the preservation of family legacy add complexity to the M&A process.

Mergers and Inquisitions

MAY 24, 2023

Part of the issue is that many different strategies fall within the “event-driven” category: merger arbitrage , activist investing , distressed investing, special situations, and more. Event-driven hedge funds differ from other funds because they rely on specific “hard catalysts,” such as acquisitions and divestitures.

How2Exit

MARCH 1, 2023

The client should be familiar with how to work with the professionals, such as lawyers, CPAs, and business valuation companies. Concept 5: Help Clients Achieve Goals Mergers and acquisitions (M&A) can be a daunting process. Attorneys should also be familiar with the laws and regulations that govern the transaction.

Devensoft

JUNE 13, 2023

Preparing for Post-Merger Integration or Divestiture In this chapter, we will discuss the steps that need to be taken before embarking on an M&A integration or divestiture transaction. For any mergers and acquisitions (M&A) or divestitures team, understanding the company’s goals and objectives is crucial for success.

Mergers and Inquisitions

MARCH 22, 2023

The deal is backstopped by the Swiss government, which committed ~$10 billion to absorb potential losses (UBS will absorb the first ~$5 billion). If the losses are even higher, UBS and the Swiss government will split them above this $15 billion level. The AT1 bondholders are now banding together to file a lawsuit.

How2Exit

MARCH 19, 2023

For example, when it comes to mergers and acquisitions, it can be difficult for a business owner to accept a lower offer for their business than what they believe it is worth. This is why the government is doing everything in their power to make capital available to small business buyers.

Sun Acquisitions

AUGUST 16, 2024

Mergers and acquisitions (M&A) transactions are complex undertakings involving many legal considerations and potential hurdles. Regulatory Compliance: M&A transactions often require regulatory approvals from government agencies, industry regulators, or antitrust authorities.

Focus Investment Banking

JANUARY 10, 2025

About 3 years ago, I joined the team at Focus Investment Banking, where I spend my time on mergers and acquisitions and capital raising within the collision repair industry. That valuation depending on how you look at it, boils down to 193% of sales or about 15 times EBITDA. So it’s an industry I love.

Viking Mergers & Acquisitions

APRIL 17, 2023

He worked with large publicly traded engineering and technology companies, small privately owned businesses, and several government entities. He joined Viking Mergers & Acquisitions in 2022 to serve the entire Myrtle Beach, Grand Strand area of South Carolina as well as the Wilmington, North Carolina, market.

InvestmentBank.com

OCTOBER 24, 2019

In fact, acquisitions by hospitals and private equity in provider services broke records last year according to Bain & Co’s 2019 global healthcare report. According to a study by Avalere Health and the Physician Advocacy Institute, hospital acquisition of physician practices in the U.S. In 2009 healthcare costs consumed 17.3%

Cooley M&A

FEBRUARY 7, 2023

Companies lacking cash turned to M&A to provide liquidity, while companies with cash on hand were able to capitalize on depressed valuations and undertake strategic transactions. Regulators, particularly in the US, are becoming more skeptical of remedies in merger cases.

The Harvard Law School Forum

JUNE 16, 2023

Related research from the Program on Corporate Governance includes Are M&A Contract Clauses Value Relevant to Target and Bidder Shareholders? Even in deals that ultimately do not include CVRs, they are frequently being discussed behind the scenes by buyers and sellers as a way to address a lack of alignment on valuation.

How2Exit

MARCH 24, 2024

rn rn rn Post-transaction, the company undergoes annual valuations, informing employees of their share value growth, fostering an ownership mindset that enhances productivity. Subscribe to Growth & Acquisitions(Formerly The Hub) ' rn rn rn ".as rn - MORE COOL STUFF rn Are you ready to take your podcast listening to the next level?

Solganick & Co.

JANUARY 9, 2024

HR Tech/HRIT mergers and acquistions January 9, 2024 – The mergers and acquisitions environment for HR technology companies in 2023 has been characterized by various trends and key developments. billion, and valuing Reward Gateway at 20x EV/EBITDA 2023e (see article for source: Edenred acquires Reward Gateway ).

Lake Country Advisors

JULY 25, 2024

Business valuation is a critical process that determines a company’s economic worth. It plays a pivotal role in various scenarios, such as mergers and acquisitions, investment decisions, and sale planning. This prudence is understandable, as market trends are essential in business valuation.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content