Why ReNew Manufacturing Solutions is Bullish on Precision Machining and Fabrication Companies

Focus Investment Banking

MAY 29, 2025

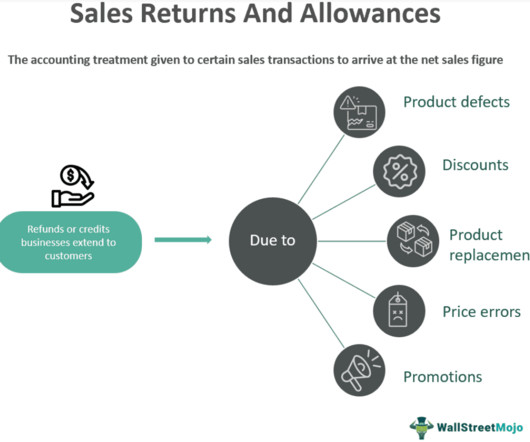

This personal connection, combined with broader market forces like the “silver tsunami” the retirement-driven sale of millions of baby boomer-owned businesses sparked ReNews strategy. Clean Up the Financials : Ensure financial statements are accurate, organized, and easy to explain. ” Ferrell said.

Let's personalize your content