Agentic AI Musings

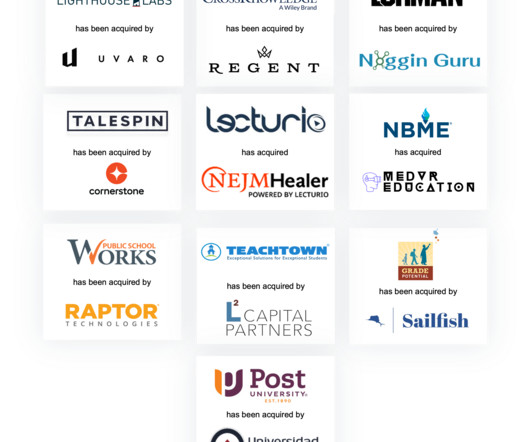

Beyond M&A

DECEMBER 18, 2024

This has been at the core of computing since it emerged, but wrapping AI and models makes these small modules very useful. billion in investor funding over the last 12 months, spread over 156 deals, an increase of 81.4 I'm noodling and tinkering with a new (free) hobby project called [link]. AI agent startups secured $8.2

Let's personalize your content