M&A in the Digital Age: How Tech is Supercharging Dealmaking

Sun Acquisitions

NOVEMBER 26, 2024

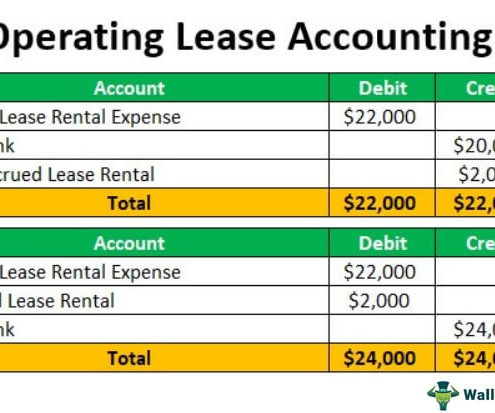

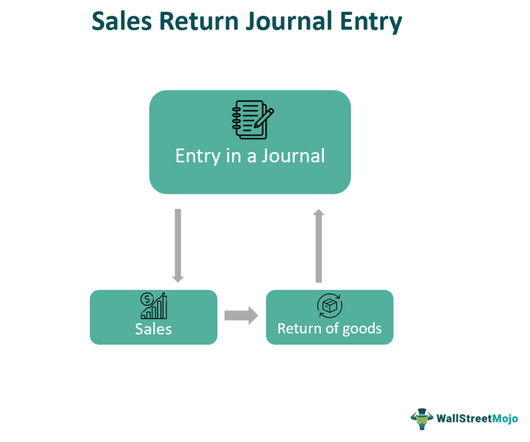

Valuation Precision: Financial modeling software powered by advanced algorithms can improve valuation accuracy. Integration platforms can help manage the process efficiently, minimizing disruption and ensuring a smoother transition for both companies’ employees.

Let's personalize your content