How top PE firms win by supporting process-driven M&A execution

Midaxo

JULY 31, 2025

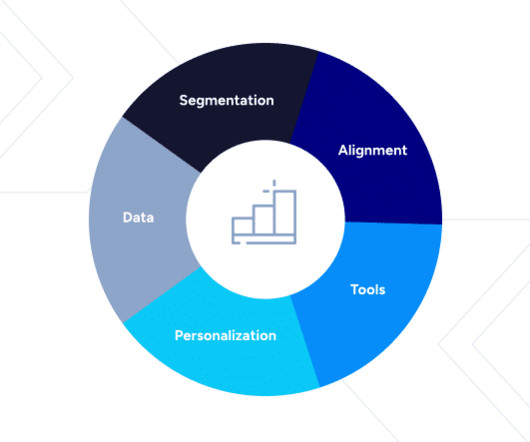

The technology Private Equity and portfolio companies need to become an M&A powerhouse. For private equity firms looking to drive value across portfolio companies , diligence cycles are tighter, competition is fiercer, and integration timelines are held under a microscope.

Let's personalize your content