Bank of America downgrades hot IPO and Nvidia derivative CoreWeave, citing valuation

CNBC: Investing

JUNE 16, 2025

" Shares of the AI cloud-computing firm have surged more than 37% so far in June and were about 4% higher on Monday.

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

CNBC: Investing

JUNE 14, 2025

Markets Currencies Cryptocurrency Futures & Commodities Bonds Funds & ETFs Business Economy Finance Health & Science Media Real Estate Energy Climate Transportation Industrials Retail Wealth Sports Life Small Business Investing Personal Finance Fintech Financial Advisors Options Action ETF Street Buffett Archive Earnings Trader Talk Tech (..)

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

How2Exit

NOVEMBER 18, 2024

Consistent Growth : Premium valuations in company sales hinge on predictable revenue and growth, amid a booming market. Wagner’s team not only identifies potential acquisition targets but also educates business owners about the transaction process. For aspiring business owners, the message is clear: Don't overlook the mundane.

Solganick & Co.

DECEMBER 20, 2024

Private Equity Influence: PE-driven deals are expected to reach record highs, driven by the availability of capital and attractive valuations in the software sector. Cybersecurity Concerns: The increasing complexity of cybersecurity threats is leading to consolidation in the cybersecurity sector. About Solganick & Co.

CNBC: Investing

JUNE 28, 2025

"We expect this to translate to scaling profitability growth and free cash flow generation," Navon said. We expect this to translate to scaling profitability growth and free cash flow generation." The firm said Roku has a plethora of streaming growth opportunities, leaving it well positioned in the second half.

CNBC: Investing

JULY 8, 2025

"While we continue to see the JPMorgan maintaining best-in-class profitability and leadership positions across its businesses, we think the bar is high for JPMorgan and we struggle to justify the current valuation," analyst Saul Martinez wrote in a note. JPM YTD mountain JPMorgan Chase stock in 2025.

CNBC: Investing

JULY 10, 2025

He's optimistic on the company's broadening customer base, product leadership and rapid new releases as well as its attractive valuation that he thinks can drive stock outperformance in the medium term. Chipmaker Broadcom should drive outsized market share in custom silicon for hyperscalers, Schneider said.

CNBC: Investing

JUNE 18, 2025

Fundamentals AAPL trades at a considerable premium over its industry despite lagging growth rates, making its valuation hard to justify based solely on profitability. Valuation risk: The stock's forward PE of 25x suggests that there are substantial risks to its valuation.

CNBC: Investing

JUNE 16, 2025

Markets Currencies Cryptocurrency Futures & Commodities Bonds Funds & ETFs Business Economy Finance Health & Science Media Real Estate Energy Climate Transportation Industrials Retail Wealth Sports Life Small Business Investing Personal Finance Fintech Financial Advisors Options Action ETF Street Buffett Archive Earnings Trader Talk Tech (..)

CNBC: Investing

JULY 13, 2025

These short ideas identify companies that JPMorgan analysts believe will see a decline in share price, giving investors an opportunity to profit from those downturns. "Reduced EV subsidies threaten already marginal profitability (EBIT margin below GM & Ford).

CNBC: Investing

JUNE 11, 2025

How to trade a downturn in the shares Published Wed, Jun 11 2025 11:01 AM EDT Tony Zhang @OptionsPlay WATCH LIVE Walmart (WMT) is facing headwinds with looming tariffs likely to erode profit margins amid an already overstretched valuation. Forward PE Ratio: 37.4x vs. Industry Average 18x Price to Sales Ratio: 1.2x

CNBC: Investing

JUNE 17, 2025

Markets Currencies Cryptocurrency Futures & Commodities Bonds Funds & ETFs Business Economy Finance Health & Science Media Real Estate Energy Climate Transportation Industrials Retail Wealth Sports Life Small Business Investing Personal Finance Fintech Financial Advisors Options Action ETF Street Buffett Archive Earnings Trader Talk Tech (..)

CNBC: Investing

JULY 14, 2025

Meanwhile, nCino's management is also confident it can achieve the so-called "Rule of 40," or have a combined revenue growth rate and profit margin that exceeds 40%. inflect growth rates closer to pre-reset levels) are able to fully recapture valuation (at pre-reset level)."

Focus Investment Banking

JANUARY 10, 2025

And in a lot of cases, these are very profitable services, but that specialization is going to lead to massive efficiencies throughout your organization. And I think to educate on some of the tactics that the big national consolidators use is smart and timely. You’re going to create a reputation for excellence in that niche.

CNBC: Investing

JULY 8, 2025

"However, we believe that the re-positioning of the company as a vertical data center provider changes the valuation structure. "[W]e'd like to see more customer diversification and progress on profitability." As such, we view shares as fairly valued."

CNBC: Investing

JUNE 19, 2025

Valuation : Fair value of $80–$85 (P/E 38–40x, EV/EBITDA 22x), supported by comps (Adidas, Lululemon). in either direction and likely still see profits without risking substantial losses in the event the stock is little changed post-earnings. Long-term margin recovery depends on full-price DTC and innovation. (1 Buy NKE Oct.

CNBC: Investing

JULY 16, 2025

Fundamentals Despite industry leading growth and profitability metrics, TSLA trades at an extreme valuation premium relative to its industry peers, significantly raising valuation risks. Analyst caution: Mixed analyst ratings, including a consensus hold rating and skepticism around valuation. Forward PE ratio: 166.4x

CNBC: Investing

JUNE 17, 2025

Markets Currencies Cryptocurrency Futures & Commodities Bonds Funds & ETFs Business Economy Finance Health & Science Media Real Estate Energy Climate Transportation Industrials Retail Wealth Sports Life Small Business Investing Personal Finance Fintech Financial Advisors Options Action ETF Street Buffett Archive Earnings Trader Talk Tech (..)

CNBC: Investing

JUNE 16, 2025

The screen does not include valuation since stocks that experience multiple contraction before corrections perform the worst during the corrections, he said. In May, Eli Lilly reported an earnings and revenue beat for its first quarter, but it lowered its full-year profit guidance because of charges related to a cancer treatment deal.

CNBC: Investing

JUNE 27, 2025

While the company said President Donald Trump's tariffs are anticipated to cost it $1 billion prior to price hikes, it also said it expects to see profits and sales declines moderating in the future. This comes as shares surged more than 9% in the premarket Friday after Nike beat analysts' expectations on the top and bottom lines.

CNBC: Investing

JUNE 30, 2025

However, the current pessimism surrounding the stock appears overdone, possibly presenting a compelling valuation even as many stocks, net of the S & P 500's rally this past week to new all-time highs, are beginning to look stretched.

CNBC: Investing

JUNE 9, 2025

CrowdStrike reported Tuesday where revenue inline with estimates and a better-than-expected profit, but guidance that was below expectations. But Bernstein downgraded CrowdStrike on Friday to market perform from outperform, citing valuation concerns. CrowdStrike trades at roughly 123 times forward earnings.

CNBC: Investing

JULY 2, 2025

S & P 500 health care stocks are selling at 17 times forward earnings, far below their historical valuation. We think the market is over extrapolating the amount of profitability and growth in the GLP-1 drugs, which Eli Lilly, of course, is, you know, the the poster child for today." market strategist for Morningstar.

CNBC: Investing

JULY 1, 2025

"At current levels — considering the growth trajectory of the business, near-term path to profitability, and below peer valuation — we see OMDA offering compelling risk/reward," Roman wrote in a Monday note to clients. That suggests roughly 58.5%

CNBC: Investing

JULY 10, 2025

Although the shift toward commercial payers from government programs like Medicaid is expected to enhance profitability, it's clear from UnitedHealth's missteps in this area that there will be some growing pains. How to profit if it does Tony Zhang This energy stock is trading near its lowest valuation on record.

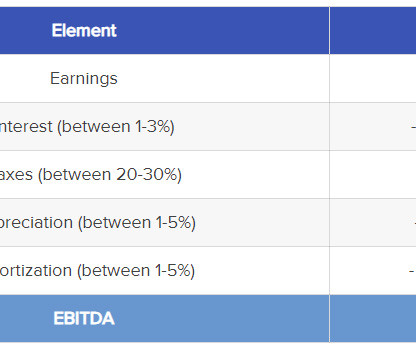

Mergers and Inquisitions

MAY 14, 2025

But just for fun, here are a few examples: Goldman Sachs : It has a Public Sector and Infrastructure group that seems to combine public finance, transportation, higher education (???), There is no consistency at all, probably because of the issues above. and sports (???).

CNBC: Investing

JUNE 11, 2025

We lean positive on underpriced OCI optionality (Stargate/Sovereigns), attractive positioning, and a reasonable valuation." "Confidence in OCI bookings strength should increase investors' appetite to buy into a FY26 rev/eps acceleration, creating a potential look-thru event should Q4 revs disappoint.

CNBC: Investing

JUNE 16, 2025

The firm upgraded the digital communications stock to buy from hold in a Sunday note, and increased its price target to $73 per share from $65, suggesting shares will rise 14% from Friday's $64.09 Shares have advanced about 11% so far in 2025.

Sica Fletcher

MARCH 14, 2024

Insurance agency valuation is a critical component of running an M&A deal, but executing this multi-step process well requires a great deal of specialized education and experience. In addition, getting the valuation process started demands a hefty bill and entails poring over extensive documentation for several weeks.

How2Exit

MARCH 24, 2024

rn rn rn ESOPs impact the community by keeping the business local, retaining jobs, and allowing profit to stay within the community rather than going to external investors. rn rn rn "The profits are building up equity that is dispersed across the employee base." rn rn rn ".as rn rn rn ".as

How2Exit

APRIL 16, 2022

People are realizing the profit potential and attractive lifestyle that comes with buying, growing and selling businesses. Articles cover everything needed to close the best deals, including financing, deal flow, market forecasts, buy/sell listings, training/advice/education, and more.

How2Exit

SEPTEMBER 9, 2024

Post-COVID, Steve pursued formal education in M&A, leading to his first acquisition in September 2020. Tune in to explore the fascinating journey of Steve, his approach to valuations, and how he successfully navigated his first acquisition during the tumultuous COVID-19 period. We look at online reviews.

Lake Country Advisors

MAY 16, 2024

More than anything, it creates a strong impression during business valuations and financial assessments. By creating content that presents a new way of thinking or educates your customers, you highlight your and your business’s authoritativeness in the industry. Social media trends and algorithms are highly volatile.

How2Exit

MAY 20, 2024

rn Today's Guest Host: rn David Green is a seasoned investor and entrepreneur dedicated to helping business owners scale and sell profitable companies. Wealth managers are not trained in the art of business valuation." These elements drive his selective process, ultimately leading to more profitable and fulfilling endeavors.

How2Exit

NOVEMBER 12, 2023

rn Building an empire requires strategic planning, a strong team, and a focus on profitability and growth. To address this knowledge gap, Coffey wrote his first book, "The Private Equity Playbook," to educate a generation about the inner workings of private equity. Um, and so the breadth is endless."

CNBC: Investing

JUNE 16, 2025

Markets Currencies Cryptocurrency Futures & Commodities Bonds Funds & ETFs Business Economy Finance Health & Science Media Real Estate Energy Climate Transportation Industrials Retail Wealth Sports Life Small Business Investing Personal Finance Fintech Financial Advisors Options Action ETF Street Buffett Archive Earnings Trader Talk Tech (..)

How2Exit

JULY 23, 2023

Education and training for both sellers and buyers are crucial in the market. 57:31) Listen Here Key Concepts We Can Learn From this Episode: Concept 1: Valuable Resource For Learning Acquisitions Divestopedia, a leading online educational resource for mid-market mergers and acquisitions, is a valuable resource for learning acquisitions.

How2Exit

OCTOBER 26, 2024

He has successfully built and exited companies, notably growing a business in the healthcare services industry to a $66 million valuation. Transitioning a business from a profitable managed company into an institutional quality asset… there's a huge gap." Do not get into a deal or an industry that you don't understand."

Mergers and Inquisitions

MARCH 8, 2023

Commodity Hedge Fund Definition: A commodity hedge fund buys and sells futures contracts and other derivatives based on mining, energy, power, and agricultural products and earns profits via fundamental and technical analysis; the trading may be systematic, discretionary, or both. If you deliver 5,000 bushels, that’s a profit of $5,000.

Tyton Partners

APRIL 1, 2024

The Tyton community was thrilled to host Cole and Toby as they discussed their respective organizations’ roles and experiences within the sports and education ecosystem, the impact recent capital markets activities have made in this space, and how they imagine this section of the market may evolve in 2024 and beyond.

Wall Street Mojo

FEBRUARY 8, 2024

Individuals often handle various types of expenses during their day-to-day life which do not come under the purview of getting compensated, like expenses related to the parking or toll payment of a personal vehicle, charity contributions, fees for education, and so on.

Wall Street Mojo

JANUARY 15, 2024

Tax accounting refers to the methods and policies used for the preparation of tax returns and other statements needed for tax compliance and therefore, it provides frameworks and guidelines for arriving at a taxable profit. read more , and taxable profit arises due to a timing issue.

Software Equity Group

MARCH 26, 2024

And it typically boils down to a few common elements that successful SaaS companies do particularly well: High-quality SaaS companies feature predictable, recurring revenues, solid unit economics , and high gross margin and gross profit rates. The firm currently employs 31 professionals. The firm employs 93 professionals.

Focus Investment Banking

JANUARY 17, 2025

I think to educate on some of the tactics that the big national consolidators use is smart and timely. Specializing helps a shop build a reputation for excellence in its niche, and bring more services in-house, many of which are highly profitable. You are not limiting yourself by specializing by increasing profitability.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content