The Unseen Hand: Tariffs and Their Profound Consequences on Mergers & Acquisitions

MergersCorp M&A International

JUNE 5, 2025

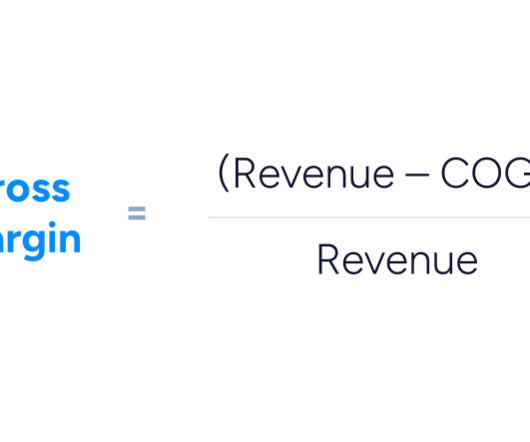

In an era marked by increasing geopolitical tensions and a re-evaluation of global trade relationships, tariffs have re-emerged as a potent tool of economic policy. Valuation models, which are typically built on projections of future earnings and cash flows, must be meticulously re-evaluated to account for these increased costs.

Let's personalize your content