Sports Investment Banking: How to Win the Super Bowl and the World Cup in the Same Year

Mergers and Inquisitions

DECEMBER 4, 2024

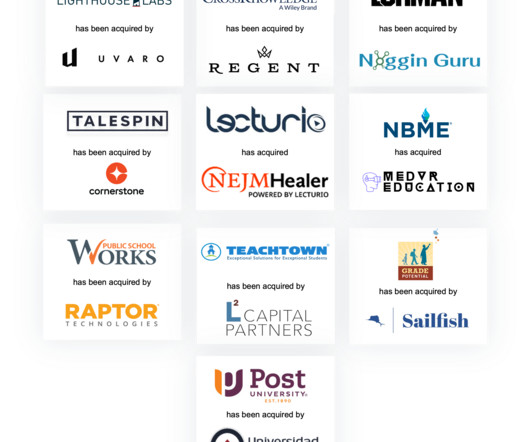

No matter the economic climate, you can always bet on sports fans to show up for their favorite teams. With teams valued at sky-high prices, deal participation is limited to institutional investors such as SWFs and PE firms (and the occasional billionaire).

Let's personalize your content