Sports Investment Banking: How to Win the Super Bowl and the World Cup in the Same Year

Mergers and Inquisitions

DECEMBER 4, 2024

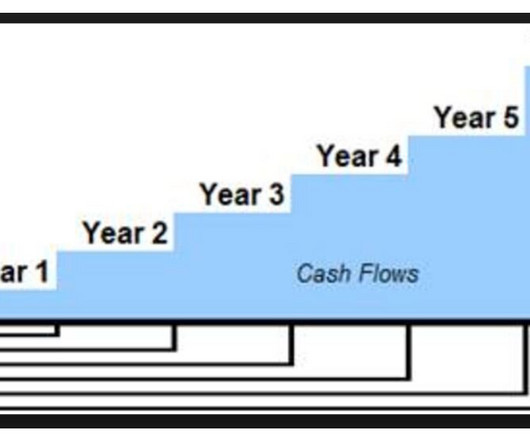

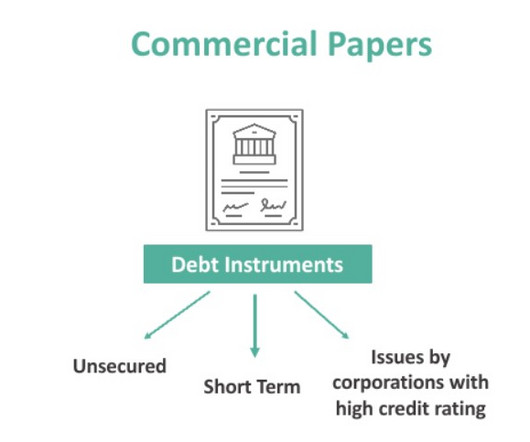

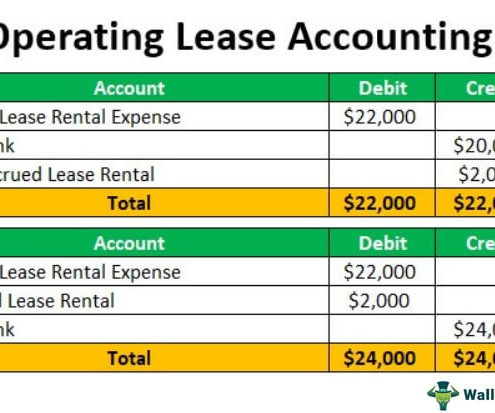

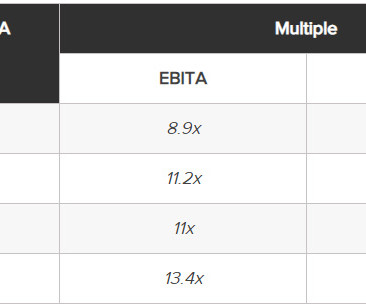

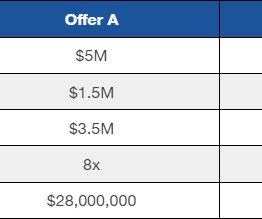

We’ll do a full breakdown of the sector here, but as usual, we need to start with the definitions, trends, and drivers: Table Of Contents What is Sports Investment Banking? Therefore, expect more debt deals for stadiums and arenas and more M&A deals , spin-offs, divestitures , minority stake purchases , and JV deals for teams and leagues.

Let's personalize your content