Broadridge’s LTX launches new AI capability for traders

The TRADE

JUNE 10, 2025

By embedding GenAI directly into our trading and investing workflows, our new capability will allow traders to make faster, more confident decisions.”

This site uses cookies to improve your experience. To help us insure we adhere to various privacy regulations, please select your country/region of residence. If you do not select a country, we will assume you are from the United States. Select your Cookie Settings or view our Privacy Policy and Terms of Use.

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

Used for the proper function of the website

Used for monitoring website traffic and interactions

Cookies and similar technologies are used on this website for proper function of the website, for tracking performance analytics and for marketing purposes. We and some of our third-party providers may use cookie data for various purposes. Please review the cookie settings below and choose your preference.

The TRADE

JUNE 10, 2025

By embedding GenAI directly into our trading and investing workflows, our new capability will allow traders to make faster, more confident decisions.”

CNBC: Investing

JUNE 28, 2025

The portfolio manager of the Gabelli Growth Fund has significant exposure to the "Magnificent Seven" companies, with Microsoft, Nvidia and Amazon being its top three holdings. " "The largest investors in AI infrastructure are generating the most attractive returns today," he said.

This site is protected by reCAPTCHA and the Google Privacy Policy and Terms of Service apply.

The TRADE

JULY 14, 2025

Previously in his career, Kilfoy also spent a decade at Canaccord Genuity, where he worked as a managing director in trading. Additionally, he has also worked as a portfolio trader at UBS. He confirmed his departure from Nomura Asset Management where he had most recently served as senior trader earlier this month.

The TRADE

JUNE 16, 2025

He has also previously held senior associate and associate positions covering portfolio management at Pimco. Prior to this, Sheridan spent more than five years at State Street in Massachusetts, where he worked as a FX middle office specialist, as well as an operations specialist.

CNBC: Investing

JUNE 6, 2025

securitized products and a portfolio manager at Janus. " JAAA YTD mountain Janus Henderson AAA CLO ETF year to date In fact, during the recent market dislocation, spreads on CLOs widened but had much less volatility than corporate credit or other parts of the bond market, he said. billion in assets under management.

CNBC: Investing

JUNE 10, 2025

We hold the iShares Bitcoin ETF (IBIT) in two of our growth-focused portfolios at Inside Edge. Corporate demand for bitcoin is also increasing as a Treasury asset. in our Active Opportunities Portfolio. To start, let's outline three fundamental reasons why bitcoin is reapproaching all-time highs. The "capped" U.S.

The TRADE

JANUARY 10, 2024

Impax Asset Management has entered into an agreement to acquire the corporate credit assets from fixed income manager Absalon Corporate Credit, part of Formuepleje Group. The post Impax Asset Management to acquire corporate credit business from partner firm Formuepleje Group appeared first on The TRADE.

The TRADE

SEPTEMBER 24, 2024

State Street Global Advisors (SSGA) has launched the first actively managed corporate and municipal target maturity bond ETFs in the US market. The suite consists of 14 actively managed target maturity ETFs with various maturity years ranging from 2026 to 2034. The suite is made up of both corporate bond and municipal bond ETFs.

The TRADE

JULY 19, 2023

Fixed income axe provision platform, Neptune Networks, has added Lloyds Bank Corporate & Institutional Banking to its bond dealer community. Following the addition, Lloyds Bank will distribute axes of GBP and EUR investment grade and high yield corporate credit as well as UK gilt through Neptune.

The TRADE

SEPTEMBER 4, 2023

Prior to joining Union, Hock spent three years at Barclays as head of equity execution sales, four years at Tungsten Capital Management as head of portfolio trading and management, and two and a half years at Ferox Capital Management in a similar role.

The Deal

OCTOBER 12, 2023

Corporations reaching settlements with activists often agree to temporarily expand their board size to add directors along with an agreement for some incumbent directors to step off at the next annual meeting. Skadden, Arps, Slate Meagher & Flom LLP partners Richard A. Grossman and Demetrius A.

The TRADE

JULY 2, 2024

“As AI continues to play a critical and transformative role in enhancing AB’s investment-research, operational and business procedures, and improving efficiencies across our corporate functions, we look forward to having an industry veteran like Andrew lead our firm into the future in this newly created role.”

Razorpay

AUGUST 9, 2023

Huge corporations have investment banks. Portfolio Management Merchant banking companies provide portfolio management services to high -net-worth individuals and corporate investors. It can also provide advice and assistance in areas such as financial management, corporate strategy and risk management.

The TRADE

JULY 15, 2024

Impax Asset Management Group has completed its acquisition of Absalon Corporate Credit’s fixed income assets. Specifically, the transaction will see Impax AM add Absalon’s global high yield and emerging market corporate debt strategies to its fixed income range. The existing fixed income team is based in the US.

OfficeHours

JUNE 12, 2023

Through a private equity internship, you will be exposed to high-stakes, complex financial transactions and gain valuable experience in investment analysis, deal structuring, and portfolio management. Securing an internship in private equity can be challenging due to the competitive nature of the industry.

Peak Frameworks

MAY 17, 2023

Consider you have ten potential investment opportunities, and you want to diversify your portfolio by selecting three. Using the combination formula , you can calculate the number of different possible portfolios as follows: 10! / (3!(10 10 - 3)!) = 120 different portfolios. Consider an investor with a portfolio of 15 stocks.

The TRADE

APRIL 17, 2024

London-based fintech C8 Technologies is set to launch an FX hedging platform which employs systemic trading models to help businesses manage their currency exposures. Jonathan Webb, former head of FX strategy at Jefferies, manages the C8 Hedge platform.

The TRADE

JUNE 29, 2023

Following its addition, the bank will distribute axes for investment grade and high yield corporate credit. This has been a client driven addition, as buy-side traders and portfolio managers continue to ask for high quality data from liquidity providers such as Mizuho.”

Mergers and Inquisitions

JULY 23, 2025

The two main divisions in CB are credit/underwriting/portfolio management and sales / “relationship management”; the latter offers a much higher pay ceiling (e.g., Not all banks have separate groups for three seemingly related fields: Commercial banking, corporate banking, and investment banking.

The TRADE

JULY 10, 2024

The platform is managed by Jonathan Webb, who previously served as head of FX strategy at Jefferies. He has also worked as a FX portfolio manager/proprietary trader at banks and hedge funds, including HSBC, Credit Suisse and Bank of America. “At

The TRADE

JULY 24, 2023

According to an update on his social media, Rutherford is departing the investment management industry after 35 years to take on a more active role in Smartframe Technologies, a venture which he has been chairman of for six years. Smartframe uses streaming technology to offer better control around publishing images online. “I

The TRADE

AUGUST 18, 2023

Most recently, Chia was head of business integration & portfolio management, technology and prior to this, worked as head of commodities specialists and execution/clearing specialists.

The TRADE

AUGUST 21, 2023

Most recently, Chia was head of business integration and portfolio management, technology and prior to this, worked as head of commodities specialists and execution/clearing specialists. The post People Moves Monday: Clear Street, Trading Technologies and more… appeared first on The TRADE.

The TRADE

NOVEMBER 27, 2023

She has been with State Street since 2000, beginning as a relationship manager. As head of State Street Global Advisors Europe – her current role – she is responsible for the firm’s EU-based portfolio management, distribution, product development, fund management and operations.

The TRADE

OCTOBER 26, 2023

While traders don’t have the authority to load up trades, outside of execution they are expected to collaborate with their portfolio managers to bring value add to the investment process by making suggestions around idea generation and execution. The trading team work closely in tandem with portfolio managers when preparing a strategy.

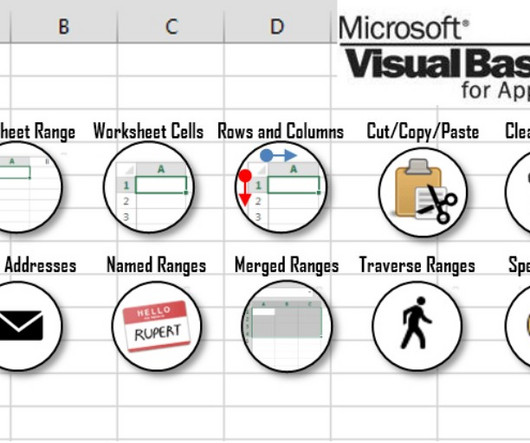

Peak Frameworks

MAY 17, 2023

For example, a corporate finance manager can use VBA to develop a dynamic dashboard that tracks key performance indicators, providing real-time insights for decision-making. For example, a portfolio manager can use VBA to generate a real-time performance dashboard that highlights key portfolio metrics and trends.

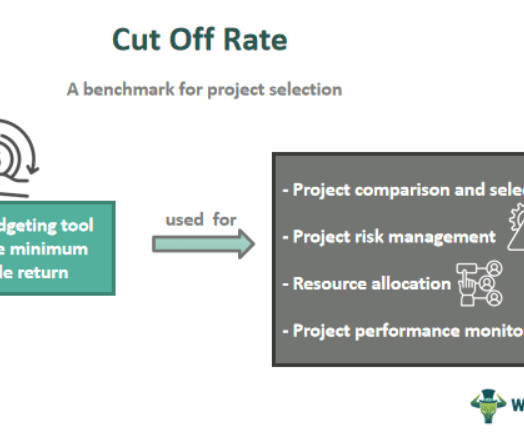

Wall Street Mojo

JANUARY 17, 2024

As this metric outlines potential returns, the cut off rate in portfolio management is a useful benchmark. Risk factors Risk plays a vital role in determining the cut off rate in portfolio management and capital budgeting. What is the cut off rate in optimal portfolio construction?

Wall Street Mojo

JANUARY 17, 2024

Initially, it was only for corporations, but as the market grew, people started perceiving the market as a way to gauge interest rate view s held by the market participants. The interest rate swap works as an amazing portfolio management tool. Government and corporate bonds are examples of fixed income investments.

M&A Leadership Council

MARCH 1, 2024

If a TSA is used, corporate staff needs a mindset change from being a captive supplier of services to being a third-party supplier. And as more companies embrace the “portfolio-managed enterprise” model, divestitures will play a more central role in these value-driven organizations, much as they do in today’s private equity firms.

The TRADE

MAY 1, 2024

It’s about risk management philosophy and methodology,” explains Papanichola. During that period of my training, I was actively taking positions, taking risk, fundamentally managing a portfolio of sorts in macro products.” Both [Cardello and Byrd] were incredibly patient with me.

Mergers and Inquisitions

MAY 24, 2023

Event-Driven Hedge Funds Definition: Event-driven hedge funds bet on specific corporate actions, such as M&A deals, divestitures, spin-offs, bankruptcies, and business reorganizations, and they profit based on changes in the value of a company’s debt or equity after the action.

The TRADE

AUGUST 14, 2023

Although there are clear differences in asset classes, I think trading fundamentals are consistent across products, so multi-asset traders and specialists really require a lot of the same skills.

Mergers and Inquisitions

APRIL 5, 2023

The firm uses passive and active strategies, often deviating from its reference portfolio based on the macro environment. You’ll also spend time supporting existing portfolio companies and reviewing their results. and supporting your Portfolio Manager ’s ideas and requests.

Mergers and Inquisitions

NOVEMBER 15, 2023

Specialized Pathways: For the Level III exam, you can focus on portfolio management, private wealth, or private markets. For example, they won’t ask about quantitative methods, derivatives, or portfolio management in a standard investment banking interview.

The TRADE

OCTOBER 24, 2024

These systems touch upon all elements of the trading lifecycle throughout the front-to-middle-to-back-office including execution, order, risk and portfolio management. Tradeweb launched its all-to-all corporate bond trading functionality in 2017. Portfolio trading Next up is portfolio trading.

The TRADE

AUGUST 25, 2023

Byron Cooper-Fogarty, chief operating officer at Neptune, at the time highlighted that “this has been a client driven addition, as buy-side traders and portfolio managers continue to ask for high quality data from liquidity providers such as Mizuho.”

The TRADE

NOVEMBER 14, 2024

The Depository Trust & Clearing Corporation (DTCC) has launched enhancements to its Value at Risk (VaR) calculator, adding cross-margining and repo transaction functionalities. Our risk management team is focused on creating new capabilities that support greater transparency for market participants.

The TRADE

MAY 28, 2025

Li will be based out of Hong Kong and brings over a decade of industry experience to her new position, with expertise covering sovereign, investment grade and high yield corporate credit and financials. She joins from Morgan Stanley, where she served as head of Asia credit analytics and head of China financing from November 2018 to May 2025.

CNBC: Investing

JULY 14, 2025

Buyback risk However, buybacks create more risk in the market, since they are discretionary, are often bought during market highs and may inflate corporate earnings, Reid explained. If a downturn hits, buybacks can stop much more quickly than dividends — and that can pull away a key pillar of market support, he said.

The TRADE

JUNE 2, 2025

Li will be based out of Hong Kong and brings over a decade of industry experience to her new position, with expertise covering sovereign, investment grade and high yield corporate credit and financials. Societe Generale Jonathan Connor has joined Societe Generale as director, euro investment grade(EUR IG) corporates trader.

Mergers and Inquisitions

MARCH 5, 2025

2) Portfolio Concentration The average biotech hedge fund has a concentrated portfolio because it takes significant time and resources to monitor each position. Finally, there are also newer/startup biotech hedge funds, often spun off from existing multi-managers.

The TRADE

MAY 27, 2025

Citi he is set to be a director in the firms corporate solutions group. Prior to his time at MUFG, he worked at UBS for a year, covering global fixed income portfolio management. In addition,Dan Smith has beenpromoted from withinto an expanded role,set to be take over as head of Australia,primefinance in theequities business.

The TRADE

JANUARY 2, 2025

From a capital markets perspective, Japan has offered the region valuable lessons in how to stimulate market activity through a package of measures and corporate governance reforms. Elsewhere in Asia, the capital markets emergence from a decade-long low interest rate environment has been slower.

Expert insights. Personalized for you.

We have resent the email to

Are you sure you want to cancel your subscriptions?

Let's personalize your content