Mergers and Acquisitions in the Age of Trump: Opportunities and Challenges

MergersCorp M&A International

NOVEMBER 16, 2024

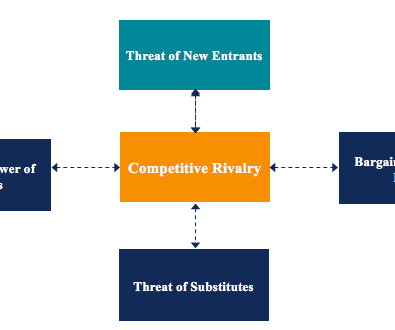

With a reduced compliance burden, firms often found it easier to navigate the M&A landscape, further accelerated by the ease of capital availability stemming from favorable monetary policy. firms, particularly in technology and pharmaceuticals, sectors that are considered critical to America’s future economic competitiveness.

Let's personalize your content