Lessons Learned from Successful M&A Deals

Sun Acquisitions

JUNE 23, 2025

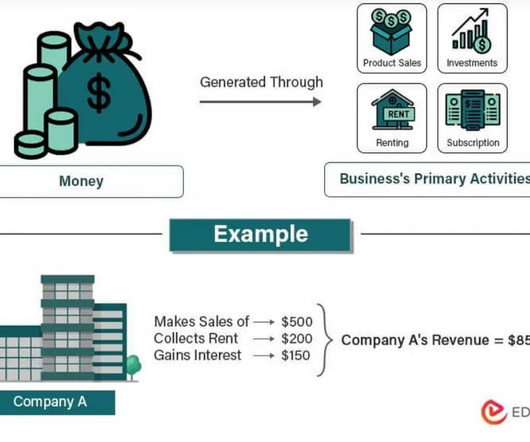

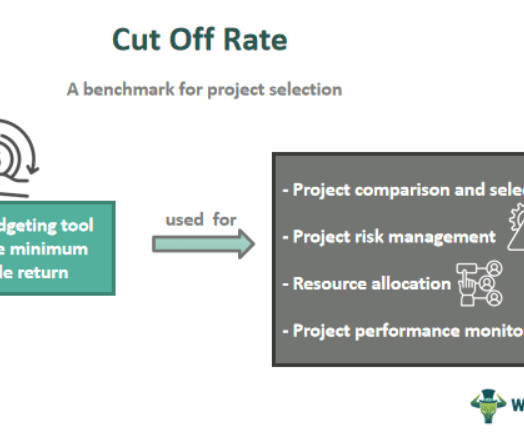

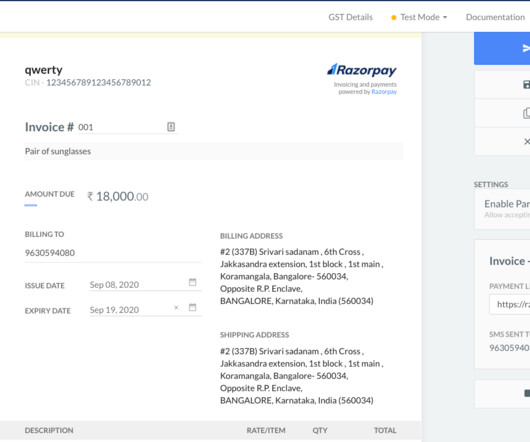

Thorough Due Diligence: Financial Due Diligence: Conduct a comprehensive financial analysis to assess the target company’s financial health, including its revenue, profitability, and debt levels. Control Costs: Implement cost-cutting measures to improve profitability.

Let's personalize your content