Can You Supercharge Your Business Growth? The Roll-Up Strategy REVEALED

How2Exit

NOVEMBER 25, 2024

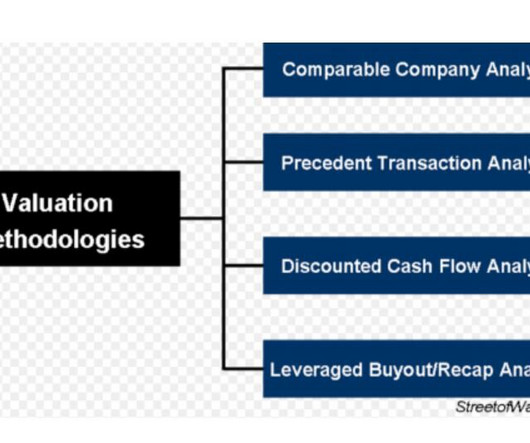

E258: Can You Supercharge Your Business Growth? He emphasizes that acquiring businesses, especially ones with complementary strengths, is often a less risky and more rewarding endeavor than organic growth or starting anew.

Let's personalize your content