The Insider’s Guide to Business Valuation

Align Business Advisory Services

MARCH 25, 2024

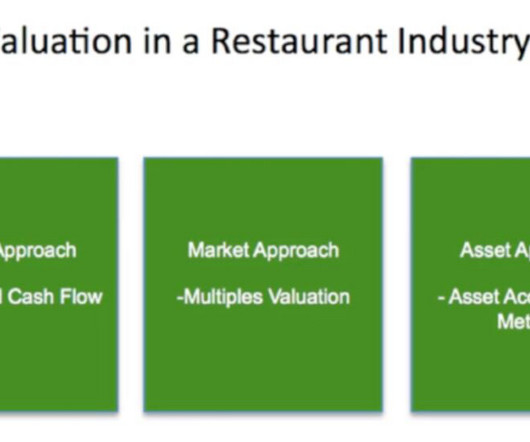

Because of this, understanding the art and science of valuation is essential. Read More » The post The Insider’s Guide to Business Valuation appeared first on Align BA.

Let's personalize your content