Mastering M&A KPIs: Goals and Getting Started

Midaxo

MARCH 19, 2025

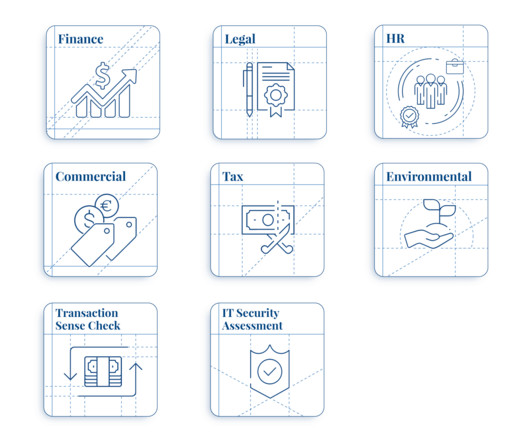

The Need for KPI Management Inorganic growth is a critical driver to business success. As private equity expands its presence, as our global interconnectivity increases, and as M&A related data sources and technologies evolve, the competitive landscape for the same deals is increasing. Data fragmentation. VDR for diligence).

Let's personalize your content