M&A in the Digital Age: How Tech is Supercharging Dealmaking

Sun Acquisitions

NOVEMBER 26, 2024

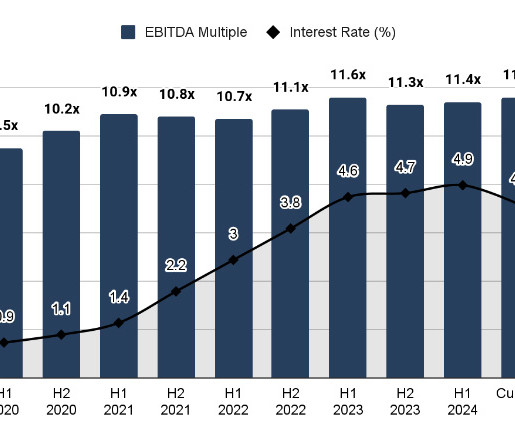

This allows companies to capitalize on fleeting market opportunities and minimize disruption to ongoing operations. Technology cannot replicate the importance of human interaction and relationship-building skills during negotiations and integration. Faster Timelines: Seize the Moment The M&A world is all about speed and agility.

Let's personalize your content