Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

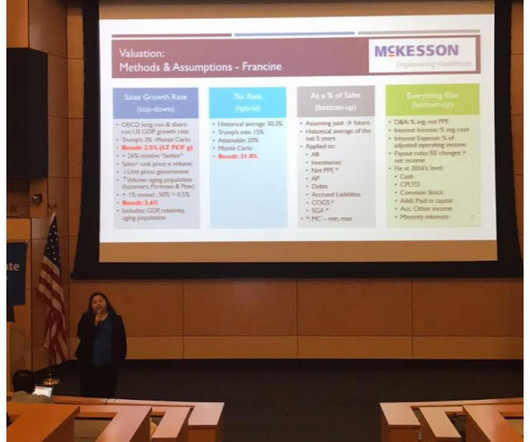

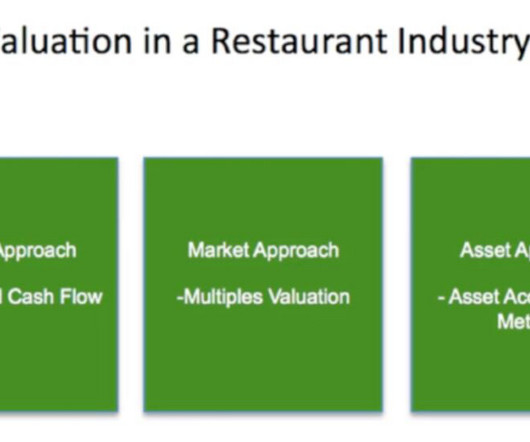

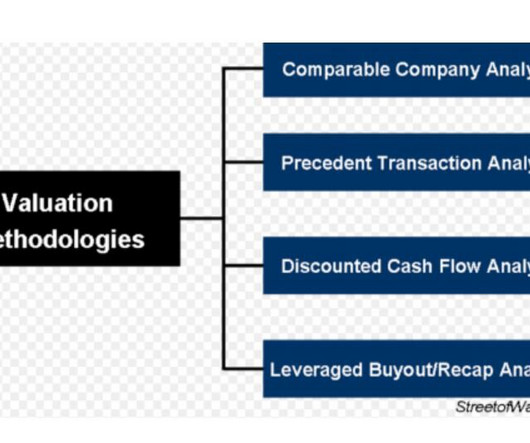

Due diligence and valuation are critical to any successful merger and acquisition (M&A) deal. Valuation: Determining the Fair Valu e Valuation is the process of determining a company’s fair market value. Accurate valuation is essential for successful M&A deals.

Let's personalize your content