Accounting Firm Mergers & Acquisitions – Financial Advisory & Valuation Services For Success

JD Supra: Mergers

JUNE 18, 2024

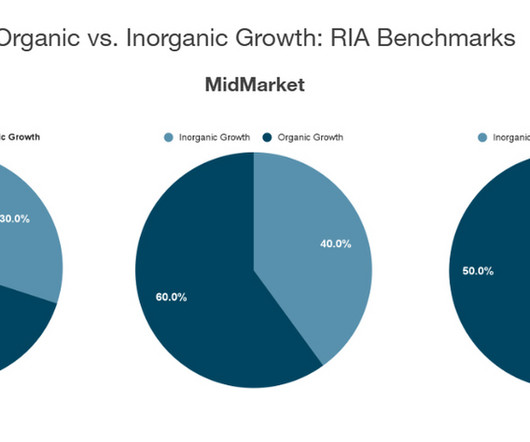

Accounting firm mergers and acquisitions (“M&A”) are blossoming due to strong recurring revenue models, a great record of organic growth over three decades, light asset investment requirements, and economic recoveries and growth worldwide following the pandemic. These factors have created the opportunity for industry consolidation.

Let's personalize your content