Best Practices for Due Diligence and Valuation in M&A

Sun Acquisitions

JUNE 27, 2025

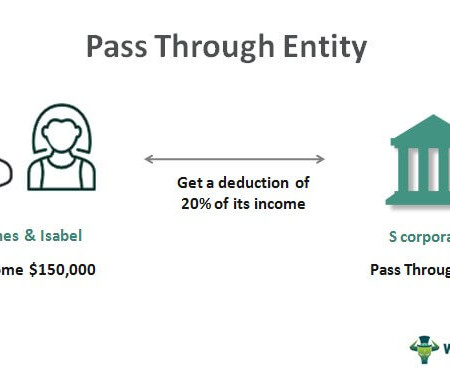

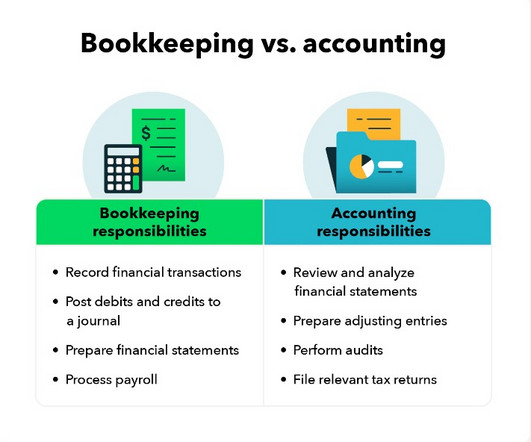

Key areas to focus on during due diligence: Financial Due Diligence: Review financial statements, tax returns, and other financial records. Assess the company’s financial performance, including revenue, profitability, and cash flow. Identify any potential financial risks or liabilities.

Let's personalize your content