Mergers & Acquisitions in a Tech-Driven World: How to Prepare Your Business

Sun Acquisitions

NOVEMBER 1, 2024

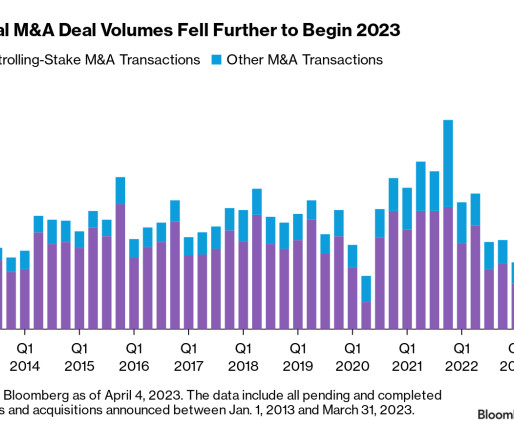

This blog post will explore how technology is reshaping M&A activities and provide strategic insights on how businesses can prepare for successful mergers and acquisitions in a tech-driven world. Talent and Culture A successful merger or acquisition often hinges on integrating talent and corporate culture.

Let's personalize your content