06-27-2023 Newsletter: Murmurings of On-Cycle 2025

OfficeHours

JUNE 27, 2023

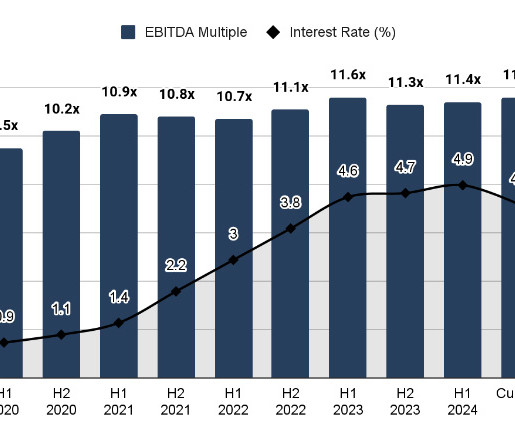

So where do we stand today… On-Cycle Buyside Recruiting UPDATE FOR 2025 Headhunters, including Henkel and Gold Coast , are already reaching out to incoming analysts about on-cycle buyside recruiting. Do you plan on recruiting for On-Cycle 2025? Maximize success with expert tips on promotion, salary negotiations, and more.

Let's personalize your content