10-23-2023 Newsletter: Why Take-Private Dealmaking Remains Attractive for PE Investors

OfficeHours

OCTOBER 23, 2023

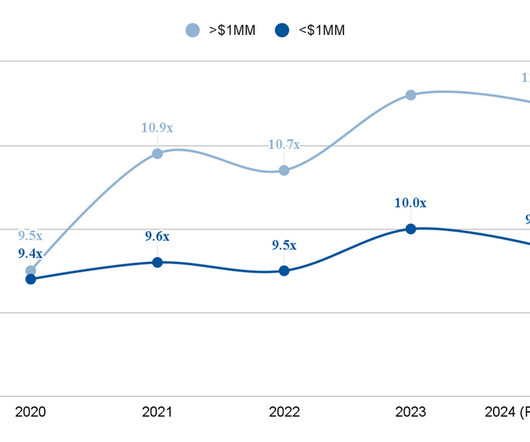

However, for private equity investors, this uncertainty represents a unique opportunity to take advantage of investment opportunities in public markets. A “take-private” transaction in the context of private equity is a process by which a PE firm acquires a publicly listed company and converts it into a privately held entity.

Let's personalize your content