What are the trends in software company valuations for 2025?

iMerge Advisors

APRIL 16, 2025

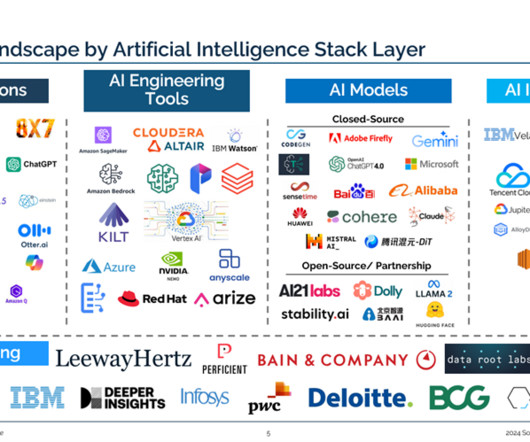

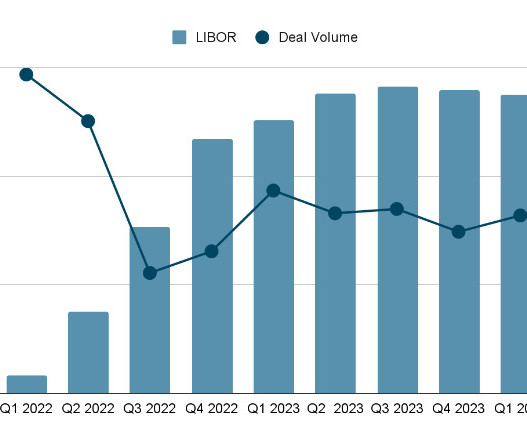

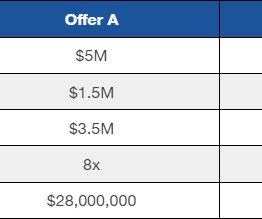

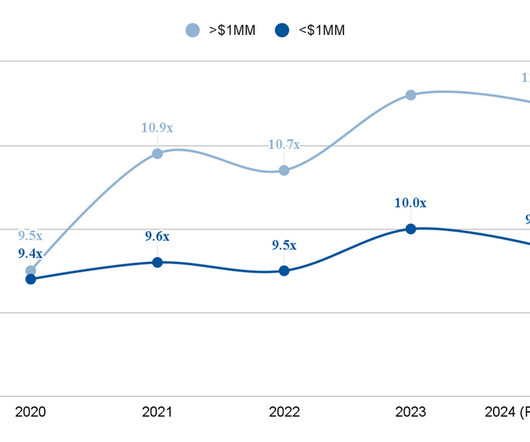

Summary of: Software Company Valuations in 2025: Trends, Multiples, and Strategic Implications As we move into 2025, software company valuations are entering a new phaseone shaped by macroeconomic recalibration, AI-driven disruption, and a more disciplined capital environment.

Let's personalize your content