Investing Principles: Lessons Learned from 20 Years of Wins, Losses, and Strikeouts

Mergers and Inquisitions

JANUARY 8, 2025

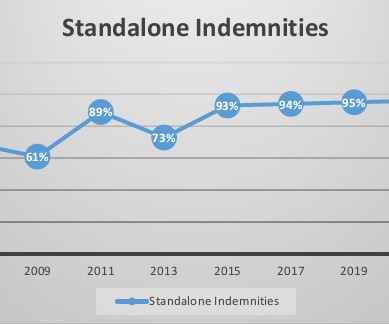

Contributions: Yes, contribute to your investment accounts regularly out of your paychecks or profits, but build a 1-year cash reserve first (you could shorten this if its unrealistically high). Investing Principles: Why a High Income Trumps Everything Else Between 2009 and 2014, I did not have a traditional portfolio via a brokerage firm.

Let's personalize your content